Navigating Consumer Confidence: Index Insights for Economic Trends

Navigating Consumer Confidence: Index Insights for Economic Trends

Understanding the Consumer Confidence Index (CCI) is vital for gauging economic sentiment and predicting market trends. In this exploration, we delve into the significance of the CCI and its impact on economic landscapes.

Defining the Consumer Confidence Index

The Consumer Confidence Index is a key economic indicator that measures the confidence levels of consumers regarding current and future economic conditions. It is compiled through surveys that assess consumers’ perceptions of the economy, employment prospects, and their personal financial situations. A high CCI reflects positive consumer sentiment, while a low index may indicate economic concerns.

CCI Components and Their Influence

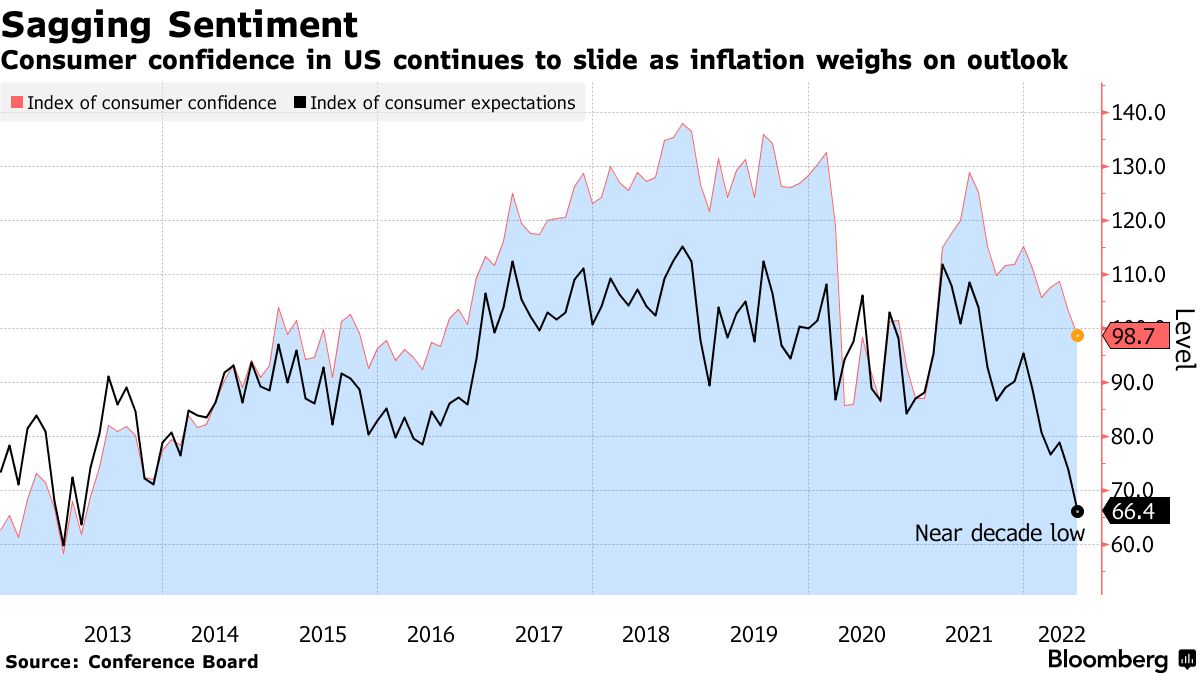

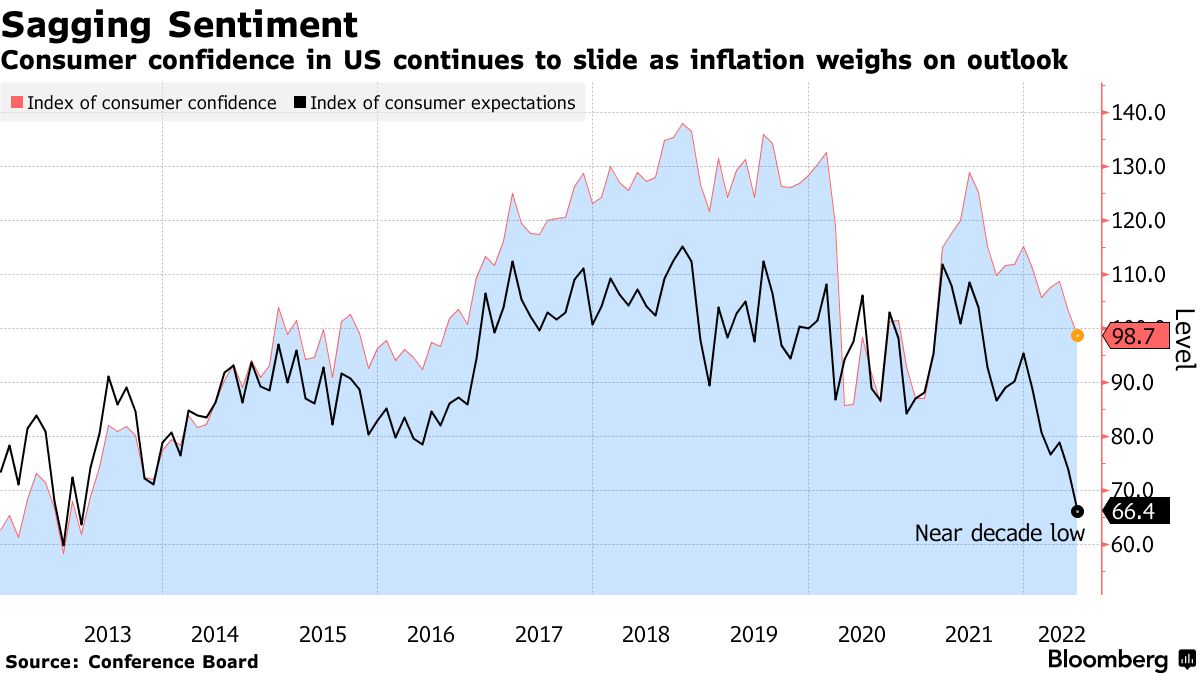

To explore the latest insights into the Consumer Confidence Index, visit vexhibits.com. The CCI comprises two main components: the Present Situation Index, reflecting current economic conditions, and the Expectations Index, gauging consumers’ outlook for the future. Understanding the interplay between these components provides a nuanced view of consumer sentiment and its potential impact on economic behavior.

Consumer Confidence and Spending Patterns

Consumer confidence is closely linked to consumer spending patterns. High confidence levels often translate into increased spending, as consumers feel optimistic about the economy and their financial stability. On the contrary, low confidence may lead to cautious spending, impacting retail, manufacturing, and overall economic growth. Monitoring the CCI assists businesses and policymakers in anticipating shifts in consumer behavior.

Employment and Income Dynamics

Consumer confidence is heavily influenced by employment and income dynamics. Favorable job markets and rising incomes contribute to positive sentiment, boosting the CCI. Conversely, job losses, wage stagnation, or economic uncertainties can lead to a decline in confidence. Recognizing the relationship between employment trends and the CCI provides valuable insights into broader economic health.

CCI as a Leading Economic Indicator

The Consumer Confidence Index is often considered a leading economic indicator, providing early signals of economic trends. High confidence levels may precede periods of economic growth, while a sudden drop in the CCI could signal a potential economic downturn. Analysts, investors, and policymakers closely monitor the CCI to make informed decisions and respond proactively to emerging economic conditions.

Impact on Financial Markets

Changes in consumer confidence can have a significant impact on financial markets. Positive CCI readings may lead to increased investment in stocks, as investors anticipate strong economic performance. Conversely, a drop in consumer confidence may result in market volatility and adjustments to investment portfolios. Understanding these market dynamics is crucial for investors navigating the ever-changing financial landscape.

Government and Central Bank Response

Government and central bank policymakers closely track the Consumer Confidence Index to inform their decisions. High confidence levels may influence policy decisions aimed at sustaining economic growth, such as interest rate adjustments or stimulus measures. Conversely, a decline in confidence may prompt policymakers to implement measures to boost consumer sentiment and economic activity.

Global Comparisons and Economic Benchmarks

To explore innovative solutions at the intersection of Consumer Confidence Index trends, visit vexhibits.com. The CCI provides a basis for global comparisons, allowing analysts to assess economic health across nations. Benchmarking against international consumer confidence trends helps policymakers and businesses gain a broader perspective on economic competitiveness and potential challenges or opportunities in the global market.

Challenges in CCI Interpretation

While the Consumer Confidence Index is a valuable tool, challenges exist in its interpretation. External factors such as geopolitical events, natural disasters, or health crises can influence consumer sentiment independently of economic fundamentals. Recognizing these challenges and incorporating a holistic approach to economic analysis enhances the accuracy of CCI interpretation.

Navigating Economic Uncertainties with the CCI

In conclusion, the Consumer Confidence Index is a crucial barometer for economic sentiment, influencing consumer behavior, financial markets, and policy decisions. Businesses, investors, and policymakers must navigate economic uncertainties by closely monitoring the CCI and responding strategically to shifts in consumer confidence. Staying informed about the pulse of consumer sentiment is essential for adapting to evolving economic landscapes and making informed decisions in a dynamic market environment.