Economic Consequences of Monetary Regulation Changes

Navigating Financial Frontiers: Unpacking the Economic Consequences of Monetary Regulation Changes

Monetary regulations form the backbone of financial systems, influencing economic stability, investment patterns, and overall fiscal health. In this exploration, we delve into the intricate economic consequences stemming from changes in monetary regulations, examining how these shifts reverberate through interest rates, inflation, and the broader financial landscape.

Interest Rate Dynamics and Borrowing Costs

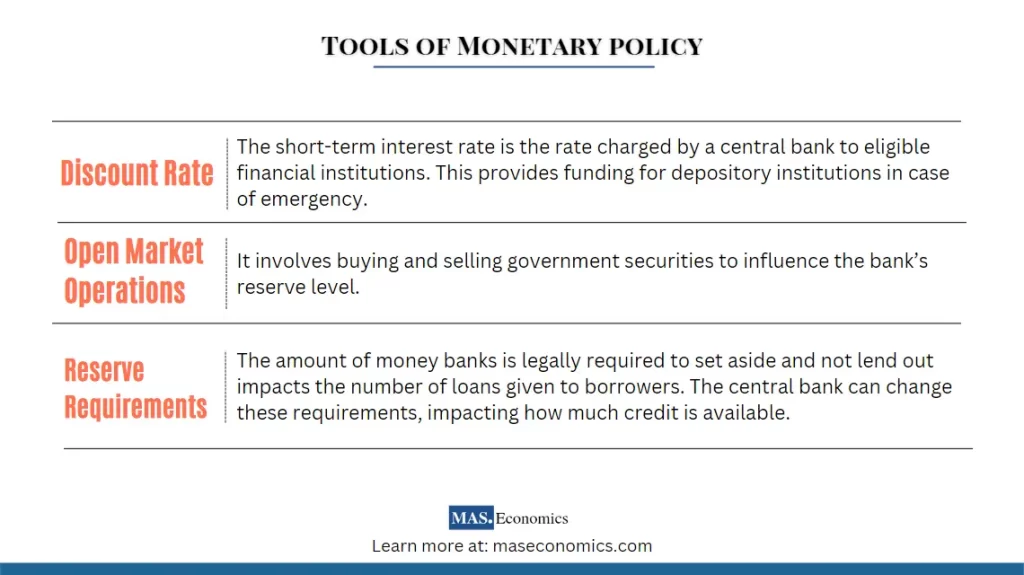

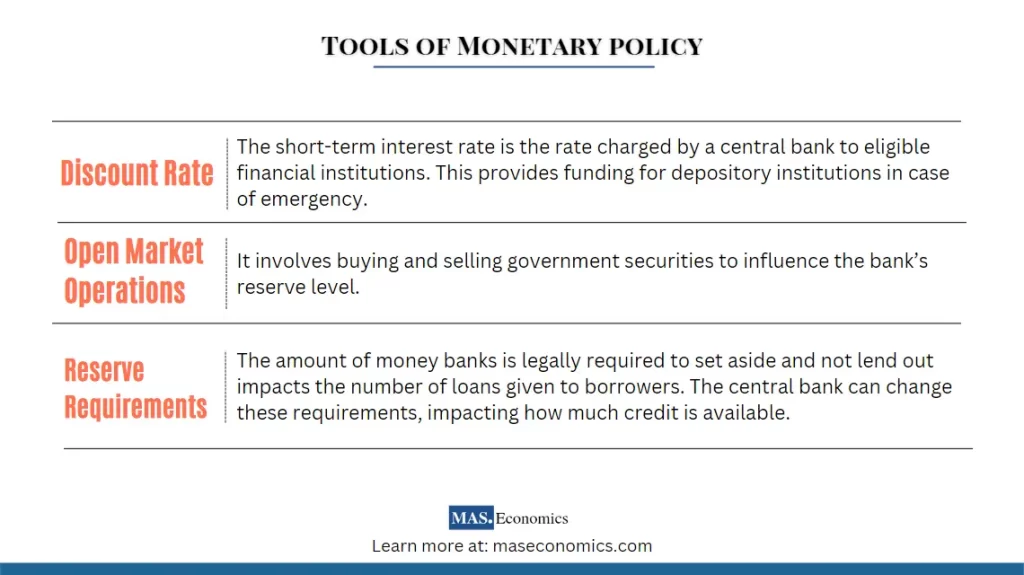

One of the primary economic consequences of changes in monetary regulations is the impact on interest rates. Regulations, such as those set by central banks, influence the cost of borrowing for individuals, businesses, and governments. Understanding the intricate relationship between regulatory shifts and interest rate dynamics is crucial for assessing the overall health of credit markets and financial activities.

Inflationary Pressures and Price Stability

Monetary regulations play a pivotal role in maintaining price stability and controlling inflation. Adjustments in regulations can influence the money supply and, subsequently, impact inflation rates. Striking the right balance is essential for fostering economic growth without allowing runaway inflation. Assessing the economic consequences involves understanding the trade-offs between growth and price stability.

Central Bank Policies and Currency Value

Changes in monetary regulations are often reflected in the policies of central banks, influencing the value of national currencies. Policies that impact currency values have implications for international trade, foreign exchange markets, and the overall competitiveness of a nation’s economy. Analyzing the economic consequences involves assessing how changes in regulations influence currency dynamics.

Impact on Investment Decisions and Capital Flows

Monetary regulations shape investment decisions and capital flows within and across borders. Policies that influence interest rates and currency values impact the attractiveness of different asset classes. Investors closely monitor regulatory changes for insights into potential shifts in returns and risks. Understanding the economic consequences requires evaluating how changes in regulations influence investment behavior.

Financial Market Volatility and Regulatory Uncertainty

Changes in monetary regulations can introduce a level of uncertainty into financial markets. Regulatory shifts may trigger volatility as market participants adjust to new conditions. Managing regulatory uncertainty is crucial for maintaining financial stability and investor confidence. Examining the economic consequences involves understanding how regulatory changes contribute to or mitigate market volatility.

Banking Sector Resilience and Regulatory Compliance Costs

The resilience of the banking sector is closely tied to monetary regulations. Regulations aimed at ensuring financial stability and preventing systemic risks impact the operations of banks. Stricter regulations may enhance resilience but can also increase compliance costs for financial institutions. Balancing regulatory requirements with the need for a robust banking sector is crucial for economic health.

Credit Availability and Economic Expansion

Monetary regulations influence credit availability, a key driver of economic expansion. Policies that support a healthy credit market contribute to increased consumer spending and business investments. Conversely, overly restrictive regulations may limit credit availability, potentially hampering economic growth. Assessing the economic consequences involves understanding how changes in regulations impact credit dynamics.

Income Distribution and Monetary Policy Effects

Monetary policies, guided by regulations, have implications for income distribution within societies. Policies that influence interest rates and inflation can impact income levels and wealth distribution. Evaluating the economic consequences involves considering how monetary regulations contribute to or alleviate income disparities and economic inequality.

International Economic Relationships and Cooperation

Monetary regulations are integral to international economic relationships and cooperation. Policies that align with global standards foster economic collaboration, trade, and financial stability. Regulatory changes may impact diplomatic and economic relations between nations. Assessing the economic consequences involves understanding the broader international implications of regulatory shifts.

Adaptability of Regulations to Economic Realities

The adaptability of monetary regulations to changing economic realities is a crucial aspect. Policies that can evolve in response to economic shifts ensure that regulations remain effective and relevant. Regulatory frameworks that support flexibility contribute to the overall resilience of financial systems. Understanding the economic consequences involves assessing how well regulations adapt to dynamic economic conditions.

Linking Economic Consequences to Policy Changes

Understanding the economic consequences of changes in monetary regulations is pivotal for policymakers, central banks, and market participants. To delve deeper into this intricate relationship, visit Economic consequences of changes in monetary regulations.

In conclusion, the economic consequences of changes in monetary regulations are far-reaching, influencing interest rates, inflation, investment decisions, and the overall stability of financial systems. Navigating these complexities requires a nuanced understanding of how regulatory shifts shape the economic landscape and impact various facets of financial activities.