cybersecurity in finance

TechRevolution: Unleashing Fintech’s Latest Advances

TechRevolution: Unleashing Fintech’s Latest Advances

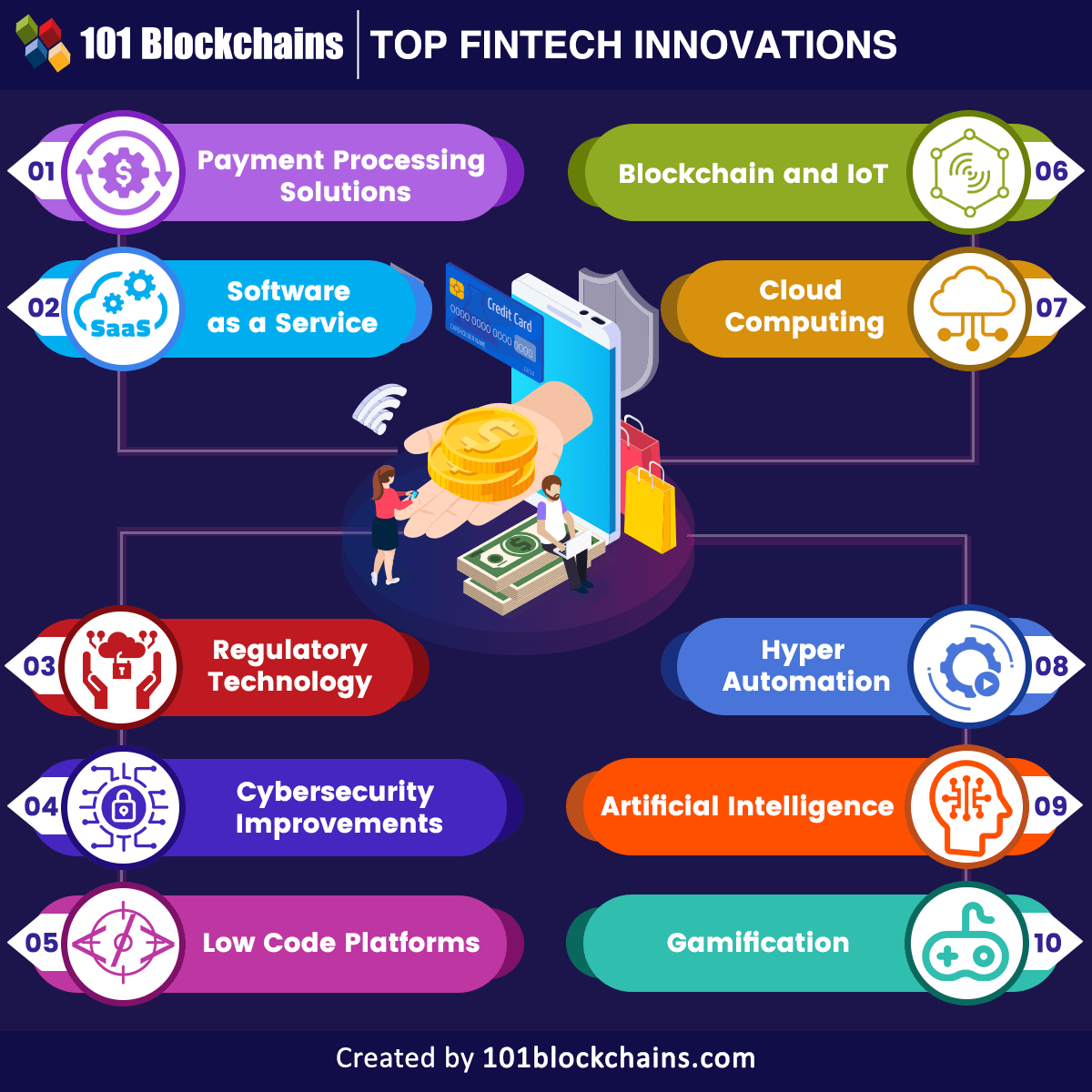

In the ever-evolving landscape of finance, Financial Technology, or Fintech, continues to spearhead revolutionary advancements. This article explores the latest trends and innovations in Fintech, examining their impact on the financial industry and showcasing how businesses can leverage these advancements for growth and efficiency.

The Rise of Fintech: A Transformative Force

Fintech has emerged as a transformative force, challenging traditional financial models and revolutionizing how financial services are delivered. The integration of technology into financial processes has led to increased efficiency, accessibility, and the democratization of financial services. From payment solutions to investment platforms, Fintech is reshaping the entire financial ecosystem.

Blockchain and Cryptocurrencies: Redefining Transactions

Blockchain technology and cryptocurrencies stand out as defining elements of Fintech innovation. Blockchain’s decentralized and secure nature revolutionizes transactions, offering transparency and trust in financial operations. Cryptocurrencies, led by Bitcoin, introduce alternative forms of value transfer, challenging conventional notions of currency and reshaping the future of financial transactions.

Digital Banking and Neobanks: Reinventing the Banking Experience

Digital banking and neobanks are redefining the banking experience for consumers. With user-friendly interfaces, streamlined processes, and reduced fees, these entities offer a convenient alternative to traditional banking. The agility of neobanks in adapting to customer needs and preferences is challenging established banks to innovate and enhance their digital offerings.

AI and Machine Learning: Enhancing Decision-Making

Artificial Intelligence (AI) and Machine Learning are integral to Fintech advancements. These technologies analyze vast datasets, identify patterns, and enhance decision-making processes. From credit scoring to fraud detection, AI-driven solutions provide accuracy, speed, and efficiency, ultimately improving the overall customer experience in financial services.

Robo-Advisors: Transforming Investment Management

Robo-advisors are automating investment management, making financial advice and portfolio management accessible to a broader audience. These automated platforms leverage algorithms to create diversified investment portfolios, optimizing returns while minimizing costs. Robo-advisors are democratizing wealth management and challenging traditional financial advisory models.

RegTech: Navigating Regulatory Challenges

As the financial industry faces increasing regulatory complexity, Regulatory Technology, or RegTech, emerges as a crucial component of Fintech. RegTech solutions leverage technology to streamline compliance processes, enhance data security, and ensure adherence to regulatory requirements. These innovations are essential for financial institutions to navigate evolving regulatory landscapes efficiently.

Fintech in Emerging Markets: Inclusive Financial Services

Fintech is making significant inroads in emerging markets, offering inclusive financial services to previously underserved populations. Mobile banking, digital wallets, and microfinance platforms empower individuals and businesses, fostering financial inclusion and contributing to economic growth in regions with limited traditional banking infrastructure.

Cybersecurity in Fintech: Safeguarding Financial Transactions

The rapid digitization of financial services brings forth new challenges related to cybersecurity. Fintech companies are investing heavily in robust cybersecurity measures to safeguard financial transactions and protect sensitive customer data. The intersection of Fintech and cybersecurity is critical for maintaining trust and ensuring the integrity of digital financial ecosystems.

Vexhibits: Showcasing Fintech Innovations

Explore how Vexhibits showcases Fintech innovations that shape the future of finance. By staying at the forefront of technological advancements, Vexhibits exemplifies how businesses can