MitigationStrategies

Navigating Federal Debt: Unraveling Consequences and Solutions

Navigating Federal Debt: Unraveling Consequences and Solutions

The issue of federal debt is a complex and pressing concern that demands careful examination. In this exploration, we delve into the consequences of escalating federal debt and explore potential solutions to mitigate its impact on economies.

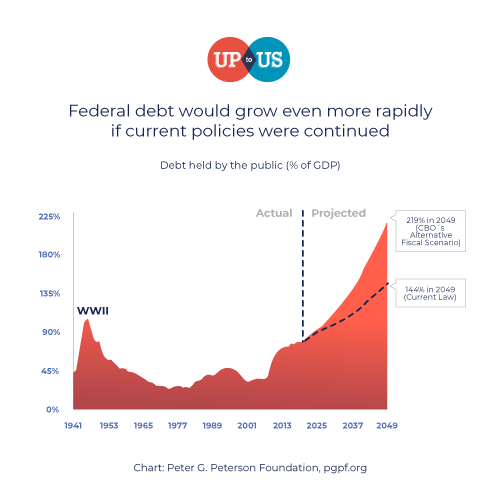

Understanding the Scope of Federal Debt

Federal debt refers to the cumulative amount that a government owes to external creditors and internal departments. It includes money borrowed through issuing bonds, bills, and notes. As this debt accumulates, it raises questions about sustainability and the potential long-term consequences for a nation’s fiscal health.

Impact on Economic Growth and Productivity

One of the primary consequences of mounting federal debt is its impact on economic growth. Excessive debt levels can hinder productivity by diverting resources towards debt servicing rather than investments in infrastructure, education, and innovation. This dynamic can lead to a slower rate of economic expansion, potentially hampering the overall prosperity of a nation.

Interest Payments and Budgetary Constraints

As federal debt grows, so do interest payments on that debt. These interest payments constitute a significant portion of the national budget, competing with other essential expenditures. The more a government spends on servicing debt, the less room there is for crucial areas such as healthcare, education, and social programs. Striking a balance becomes essential to prevent budgetary constraints.

Inflationary Pressures and Monetary Policy Challenges

Escalating federal debt can also exert inflationary pressures on an economy. When a government resorts to printing more money to service its debt, it can contribute to rising inflation rates. Central banks may face challenges in implementing effective monetary policies to control inflation while simultaneously managing the burden of mounting debt.

Potential Impact on Interest Rates and Borrowing Costs

The relationship between federal debt and interest rates is intricate. High levels of debt can increase uncertainty in financial markets, leading to higher interest rates. Elevated interest rates, in turn, raise the costs of borrowing for businesses and consumers alike. This scenario can stifle investment, curb consumer spending, and create headwinds for economic growth.

Global Confidence and Credit Ratings

The level of federal debt influences global confidence in a nation’s economic management. Excessive debt levels can lead to a downgrade in a country’s credit rating, signaling to investors that the government may struggle to meet its financial obligations. A lowered credit rating can result in higher borrowing costs and diminished foreign investment.

Long-Term Fiscal Sustainability and Intergenerational Equity

Sustainable fiscal policies are crucial for intergenerational equity. Excessive federal debt places a burden on future generations as they inherit the financial consequences of decisions made by previous administrations. Prioritizing long-term fiscal sustainability is an ethical consideration that aims to ensure fairness and prosperity for generations to come.

Balancing Act: Strategies for Mitigation

To explore innovative solutions at the intersection of Federal Debt and its Consequences, visit vexhibits.com. Addressing federal debt requires a multifaceted approach. Implementing policies that focus on responsible fiscal management, controlling government spending, and fostering economic growth are integral components of a balanced