Revenue strategies

Balancing the Books: Navigating the Federal Budget and Deficit

Economic Stewardship: Navigating the Federal Budget and Deficit Landscape

Efficient management of the federal budget and deficit is a cornerstone of economic governance. This article delves into the complexities of balancing the books at the federal level, exploring the intricacies of budgetary decisions, the implications of deficits, and strategies for fiscal responsibility.

Budgetary Basics: Understanding the Federal Budget

At the heart of economic governance is the federal budget, a comprehensive financial plan outlining government expenditures, revenue sources, and financial goals. Understanding the components of the federal budget provides insights into the priorities and policy directions set by the government.

Revenue Streams: Funding the Federal Budget

Federal budgets rely on diverse revenue streams, including taxes, tariffs, and other income sources. The balance between taxation and spending is a delicate dance, and decisions about revenue generation impact citizens, businesses, and the overall economic landscape. Examining revenue strategies is pivotal for sustainable fiscal policies.

Expenditure Priorities: Allocating Resources Effectively

Deciding where to allocate resources within the federal budget is a crucial aspect of economic governance. Prioritizing spending on areas such as healthcare, education, defense, and infrastructure reflects the government’s policy objectives. Analyzing expenditure priorities provides insights into societal values and government commitments.

Deficit Dynamics: Unraveling the Federal Deficit

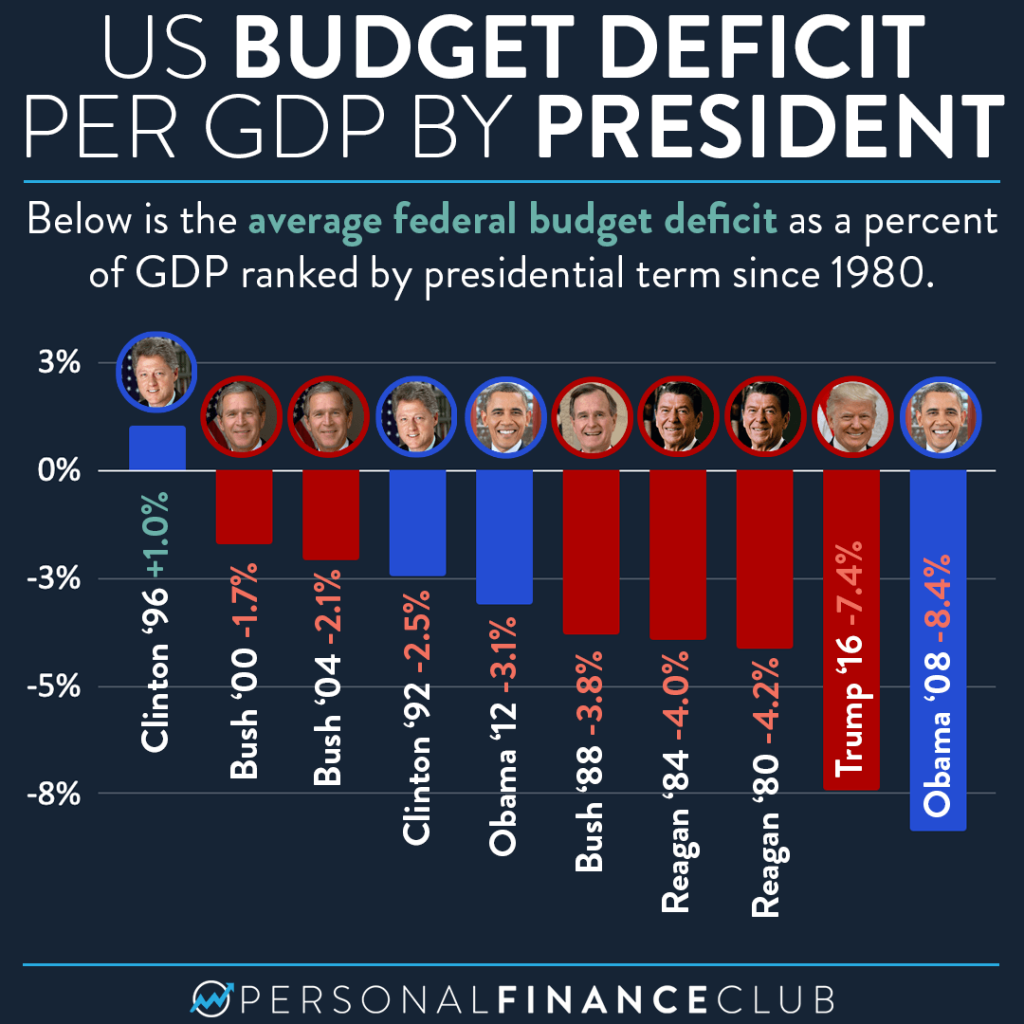

When government expenditures exceed revenues, a budget deficit occurs. Understanding the dynamics of deficits is essential, as they can lead to increased borrowing and impact long-term fiscal health. Scrutinizing deficit patterns helps assess the sustainability of government finances and potential impacts on the economy.

Debt Accumulation: Managing the National Debt

Persistent deficits contribute to the accumulation of national debt. Managing this debt is a critical task for economic stewards. Balancing the need for government spending with the imperative to limit debt growth requires strategic fiscal policies and a long-term view of economic sustainability.

Economic Stimulus vs. Austerity: Policy Approaches

During economic downturns, governments face the dilemma of whether to implement stimulus measures or adopt austerity policies. Stimulus packages involve increased spending to boost the economy, while austerity focuses on reducing deficits. Examining the pros and cons of these approaches guides decision-making in times of economic uncertainty.

Impact on Financial Markets: Investor Confidence and Interest Rates

Government fiscal policies, especially those related to the federal budget and deficit, influence investor confidence and interest rates. The perception of sound economic management can attract investments, while concerns about deficits may lead to higher interest rates. Monitoring these market dynamics is crucial for economic stability.

Long-Term Planning: Sustainable Fiscal Policies

Fostering sustainable fiscal policies involves long-term planning. Governments must balance the immediate needs of citizens with the imperative to secure the nation’s financial future. Strategic decision-making, effective resource allocation, and a commitment to fiscal responsibility contribute to sustainable economic governance.

Visit Federal Budget and Deficit for In-Depth Insights

For a deeper exploration of the federal budget and deficit landscape, visit Federal Budget and Deficit. The curated analysis and information provided can empower individuals, businesses, and policymakers with the knowledge needed to navigate the complexities of fiscal governance.

In