startups

Startups USA: Nurturing Innovation and Entrepreneurship

Introduction:

In the dynamic landscape of business and innovation, startups in the USA play a pivotal role in shaping the future. This article delves into the vibrant ecosystem of startups, exploring the factors contributing to their success and their impact on the broader entrepreneurial landscape.

The Proliferation of Innovation:

Startups in the USA are synonymous with innovation. Fueled by a spirit of entrepreneurship, these ventures constantly push the boundaries of what’s possible. From cutting-edge technology solutions to novel approaches in traditional industries, the proliferation of innovation within startups is a driving force in the evolution of the business landscape.

Tech Hubs and Entrepreneurial Hotspots:

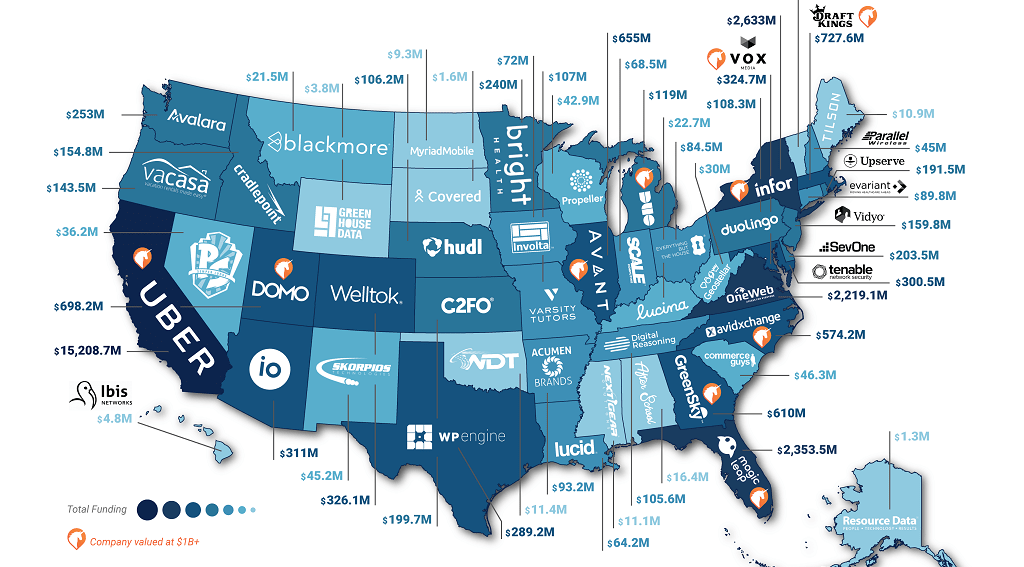

Certain cities across the USA have emerged as prominent tech hubs and entrepreneurial hotspots. Silicon Valley in California, the Boston-Cambridge area in Massachusetts, and Austin, Texas, are just a few examples. These locations foster an environment conducive to startup growth, offering access to talent, funding, and a collaborative ecosystem that propels innovation forward.

Funding Landscape and Venture Capital:

The success of startups often hinges on their ability to secure funding. The USA boasts a robust venture capital landscape, with investors actively seeking promising ventures. From angel investors to venture capitalists, startups navigate a competitive landscape to secure the funding necessary for growth and development.

Challenges and Resilience:

While startups are known for their innovation, they also face numerous challenges. From navigating regulatory landscapes to managing cash flow, the journey is not without hurdles. However, the resilience embedded in the startup culture enables these businesses to adapt, learn from setbacks, and ultimately thrive in the face of challenges.

Ecosystem Support and Incubators:

Supportive ecosystems and incubators play a crucial role in the success of startups. These entities provide resources, mentorship, and networking opportunities that empower entrepreneurs. By fostering a collaborative environment, startups can leverage the collective expertise within these ecosystems to overcome obstacles and accelerate their growth trajectory.

Diversity and Inclusion Initiatives:

Efforts to enhance diversity and inclusion within the startup ecosystem are gaining prominence. Recognizing the value of diverse perspectives, startups in the USA are actively implementing initiatives to ensure inclusivity. This not only aligns with societal values but also contributes to a more innovative and dynamic business environment.

Impact on Job Creation:

Startups are significant contributors to job creation in the USA. As these ventures expand, they generate employment opportunities, contributing to economic growth. The agility and growth potential of startups make them vital players in shaping the employment landscape and fostering a culture of entrepreneurship.

Global Reach and Market Disruption:

In an interconnected world, startups in the USA often have a global reach. Leveraging technology and innovative business models, these ventures disrupt traditional markets and create new opportunities on a global scale. The ability to scale rapidly and enter international markets is a hallmark of successful startups.

Corporate Collaboration and Partnerships:

Established corporations recognize the agility and innovation that startups bring to the table. Increasingly, there is a trend of corporate collaboration with startups through partnerships, accelerators, and strategic investments. This mutually beneficial relationship

Should Startups Focus On Profitability? Both Sides Of The Table

YouTube has one billion monthly users—nearly one-third of all folks on the internet—and tens of millions of hours of video are watched every single day on the video platform. If your company’s current return on property is lower than it was a 12 months ago, you need to have a look at what has changed in the way in which your company is using its sources. Return on investment is considered by many executives to be crucial profitability ratio.\n\nCalculate the return on property and return on investment in your company. RMA Annual Statement Studies , RMA — The Threat Management Association Information for 325 traces of business, sorted by asset dimension and by sales volume to allow comparisons to firms of similar dimension in the same trade.\n\nAlmanac of Business and Industrial Financial Ratios , annual, by Leo Troy. For many years Rickenbacker’s Jap was essentially the most profitable airline in the country. Nicely, food and beverage could be a good margin, depending on how price-effective the house is being run, but actually rooms are essentially the most profitable part of the business.\n\nAnyone who’s taken a fundamental business course knows tips on how to calculate earnings. You add up whole revenues and subtract whole costs, and whatever’s left is your profit. For example, Company A spends $900,000 to sell $1 million in services and products, generating $a hundred,000 in earnings.\n\nThe easy answer isn’t any. The more a company spends to generate a chosen profit, the more susceptible it is to minor price shifts, which may rapidly put it out of business. For example Company A above spends $200,000 in medical health insurance costs, and those costs enhance by 10 p.c.…