Supply Chain Disruptions

Global Events’ Impact on US Economy: A Comprehensive Analysis

Navigating Economic Tides: The Impact of Global Events on the US Economy

Global events wield a profound influence on the economic landscape, shaping the trajectory of nations and markets. This article delves into the intricate web of connections, exploring how international occurrences reverberate through the veins of the United States economy.

Global Economic Interdependence

In an era of unprecedented connectivity, the global economy operates as an intricate web of interdependence. The United States, as a major player, is not immune to the ripple effects of global events. Economic ties, trade partnerships, and financial linkages make the nation susceptible to shifts in the global economic landscape.

Trade Dynamics and Market Fluctuations

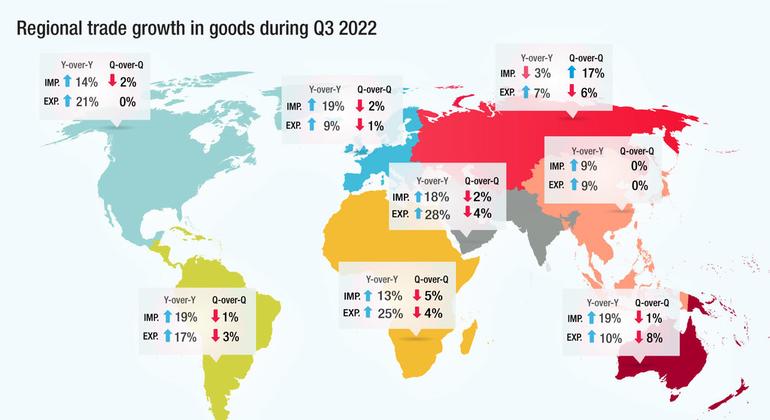

International trade is a cornerstone of the US economy, and global events can significantly impact trade dynamics. Trade tensions, geopolitical developments, and disruptions in key economic regions can trigger market fluctuations, affecting industries ranging from manufacturing to technology. Businesses must navigate these shifts to maintain resilience and competitiveness.

Currency Valuation and Exchange Rates

Global events influence currency valuations and exchange rates, with implications for US businesses and consumers. Political uncertainties, economic crises, or geopolitical tensions can lead to currency fluctuations, impacting the purchasing power of the US dollar. Monitoring these changes is crucial for businesses engaged in international trade and investment.

Commodity Prices and Inflation Pressures

The global marketplace plays a pivotal role in determining commodity prices, and fluctuations in these prices can have cascading effects on the US economy. Rising commodity prices, driven by events such as geopolitical tensions or natural disasters, can contribute to inflationary pressures, affecting consumer spending and business operations.

Financial Markets and Investor Confidence

Global events have a direct bearing on financial markets, influencing investor confidence and market sentiment. Economic crises, political instability, or major geopolitical developments can lead to market volatility. Investors closely watch these events, adjusting their portfolios in response to emerging trends, impacting the overall stability of financial markets.

Supply Chain Disruptions and Business Operations

The interconnected nature of global supply chains exposes US businesses to the risk of disruptions triggered by international events. Natural disasters, trade disputes, or geopolitical tensions can disrupt the flow of goods and materials, affecting the operations of businesses across various sectors. Mitigating these risks requires strategic supply chain management.

Government Policies and Economic Resilience

Global events often prompt governments to adjust policies to safeguard their economies. US policymakers must respond to international developments, balancing economic stability with strategic interests. Well-crafted policies can enhance the resilience of the US economy in the face of external shocks and foster sustained growth.

Emerging Opportunities in Global Shifts

While global events pose challenges, they also present opportunities for the US economy. Emerging markets, technological advancements, and changing consumer behaviors driven by international trends can create avenues for growth. US businesses that stay agile and adaptable can leverage these shifts to their advantage.

Social and Environmental Considerations

Global events extend beyond economic dimensions, encompassing social and environmental factors. Issues such as climate change, pandemics, and social movements can have profound implications

Global Trade Unveiled: Latest International Market Insights

Global Trade Unveiled: Latest International Market Insights

The world of international trade is ever-changing, influenced by geopolitical shifts, economic developments, and technological advancements. This article unravels the latest updates in international trade, providing insights into the trends, challenges, and opportunities that businesses need to navigate in the dynamic global marketplace.

Geopolitical Dynamics and Trade Agreements

Geopolitical dynamics play a pivotal role in shaping international trade. The status of trade agreements, diplomatic relations, and geopolitical tensions can significantly impact the flow of goods and services between nations. Businesses must stay abreast of these developments to anticipate changes in trade regulations and market access.

Technological Innovations Driving Trade Efficiency

Technological advancements continue to revolutionize international trade. From blockchain for transparent supply chains to digital platforms for seamless transactions, technology enhances trade efficiency. Businesses that embrace and integrate these innovations gain a competitive edge in navigating the complexities of global commerce.

Economic Shifts and Market Trends

Economic shifts in major economies influence global trade trends. Changes in GDP, inflation rates, and consumer spending patterns impact the demand for goods and services. Understanding these economic indicators is crucial for businesses involved in international trade, allowing them to adjust strategies based on market trends.

Impact of Pandemic on Supply Chains

The global pandemic has brought unprecedented challenges to supply chains. Disruptions in transportation, factory closures, and increased demand for certain goods have reshaped the dynamics of international trade. Businesses are reevaluating and diversifying their supply chain strategies to build resilience in the face of unexpected disruptions.

Environmental Considerations and Sustainable Trade Practices

Environmental sustainability is becoming a focal point in international trade. Consumers and governments alike are placing greater emphasis on eco-friendly and sustainable practices. Businesses that adopt environmentally conscious strategies, such as reducing carbon emissions and promoting ethical sourcing, can position themselves favorably in the evolving global market.

Trade Compliance and Regulatory Landscape

Trade compliance remains a critical aspect of international business. Navigating the complex regulatory landscape, including customs regulations, tariffs, and trade sanctions, requires a comprehensive understanding of international trade laws. Businesses must stay compliant to avoid legal challenges and maintain smooth cross-border operations.

Vexhibits: Navigating International Trade Challenges

Explore how Vexhibits navigates the challenges of international trade. By staying informed about geopolitical dynamics, embracing technology, and prioritizing sustainable practices, Vexhibits showcases effective strategies for success in the international business arena.

E-Commerce and Cross-Border Transactions

E-commerce has transformed the landscape of cross-border transactions. Online marketplaces and digital platforms connect buyers and sellers across borders, offering new opportunities for businesses of all sizes. Understanding the nuances of e-commerce in international trade is essential for capitalizing on the growing digital economy.

Diversification Strategies for Risk Mitigation

In a rapidly changing global environment, diversification is a key strategy for risk mitigation. Businesses that diversify their markets, suppliers, and distribution channels are better equipped to weather economic uncertainties and geopolitical challenges. Strategic diversification enhances resilience in the face of unforeseen disruptions.

International Trade Finance and Currency Fluctuations

Currency fluctuations and international trade finance are intricately linked. Businesses

Balancing Act: Economic Impacts of Resource Depletion

Balancing Act: Economic Impacts of Resource Depletion

Natural resource depletion poses a significant challenge to economies worldwide, unraveling a complex web of economic consequences. This exploration navigates the intricate dynamics that stem from the depletion of essential resources, shedding light on the profound effects on businesses, societies, and the global economy.

Dwindling Resources and Rising Costs

The depletion of natural resources often leads to a scarcity scenario, triggering a surge in costs. As the availability of resources diminishes, the demand-supply dynamics come into play, elevating the prices of essential commodities. Industries reliant on these resources face increased production costs, subsequently impacting the prices of goods and services across various sectors. This domino effect creates economic challenges for businesses and consumers alike.

Impacts on Agricultural Productivity and Food Security

Agriculture, a sector heavily dependent on natural resources, bears the brunt of resource depletion. Depleted soil fertility, water scarcity, and climate-related challenges adversely affect agricultural productivity. The ripple effect extends to food security, as diminished agricultural output can lead to increased food prices and heightened vulnerability to global food supply shocks. Striking a balance between resource use and sustainable agricultural practices becomes imperative for long-term food security.

Energy Crisis and Economic Slowdown

The depletion of fossil fuels and other energy resources contributes to an energy crisis, with far-reaching economic implications. Industries reliant on abundant and affordable energy sources face disruptions, leading to potential economic slowdowns. The transition to alternative and sustainable energy sources becomes not only an environmental necessity but also an economic imperative to ensure energy security and mitigate the risks associated with resource depletion.

Erosion of Biodiversity and Economic Consequences

Resource depletion often accompanies the loss of biodiversity, disrupting ecosystems and ecological balance. The economic consequences of biodiversity loss are multifaceted, impacting industries such as pharmaceuticals, agriculture, and tourism. The loss of plant and animal species can affect medical discoveries, crop pollination, and tourism revenue, underscoring the intricate connections between biodiversity and economic well-being.

Water Scarcity and Industrial Challenges

Water, a critical resource for various industries, faces depletion and scarcity in many regions. Industries relying on water-intensive processes, such as manufacturing and agriculture, encounter challenges in securing adequate water supplies. Water scarcity not only affects production processes but also contributes to regional economic disparities and social tensions. Sustainable water management practices become essential to address the economic impacts of water depletion.

Mineral Resource Depletion and Supply Chain Disruptions

Minerals and metals play a pivotal role in various industries, from electronics to construction. Depletion of mineral resources poses a risk of supply chain disruptions, affecting manufacturing and technological innovation. Industries reliant on specific minerals may face increased costs and uncertainties in securing a stable supply. Diversifying sources and implementing recycling initiatives become crucial strategies to mitigate the economic effects of mineral resource depletion.

Overfishing and the Fisheries Industry

Overfishing contributes to the depletion of marine resources, impacting the fisheries industry and coastal economies. Declining fish stocks lead to reduced catches, affecting the livelihoods of those dependent on fishing. The economic consequences