Navigating USA’s Monetary Policy for Economic Stability

Navigating USA’s Monetary Policy for Economic Stability

Monetary policy in the United States is a dynamic and influential force, shaping the nation’s economic landscape. This article delves into the intricate world of USA’s monetary policy, exploring its components, objectives, and impact on fostering economic stability.

The Federal Reserve’s Mandate

At the heart of monetary policy in the USA is the Federal Reserve, commonly known as the Fed. Endowed with the responsibility of promoting maximum employment, stable prices, and moderate long-term interest rates, the Fed plays a crucial role in steering the nation’s economic course. This mandate underscores the importance of a balanced and resilient economy.

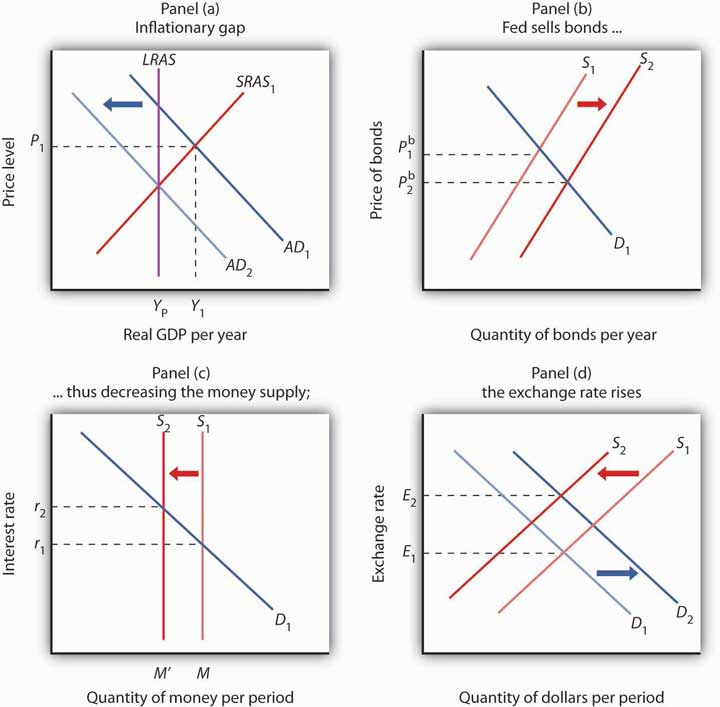

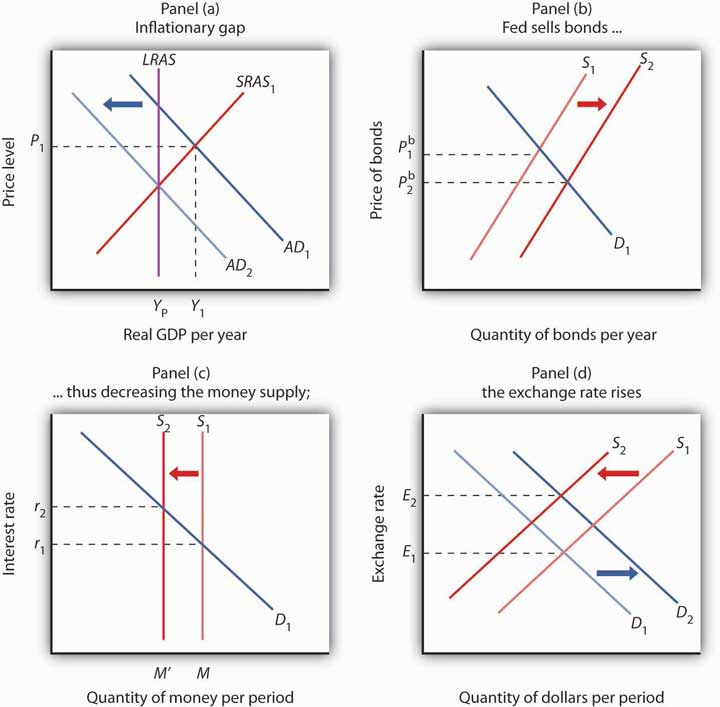

Interest Rates and the Money Supply

One of the primary tools in the Fed’s toolkit is the management of interest rates. By influencing short-term interest rates, the Fed aims to control the money supply and, consequently, economic activity. Lowering interest rates encourages borrowing and spending, stimulating economic growth, while raising rates can help cool down an overheated economy and control inflation.

Inflation Targeting

Maintaining price stability is a key objective of USA’s monetary policy. The Fed employs an inflation targeting approach, striving to keep inflation at a moderate and predictable level. This commitment to price stability contributes to a more predictable economic environment, fostering consumer and investor confidence.

Employment and Economic Output

The pursuit of maximum employment is another critical aspect of USA’s monetary policy. The Fed seeks to create conditions that support job growth and reduce unemployment to levels consistent with a healthy and thriving economy. By carefully managing interest rates and economic stimuli, the Fed aims to strike a balance that fosters sustainable employment.

Quantitative Easing and Unconventional Tools

In times of economic stress or crisis, the Fed may resort to unconventional tools like quantitative easing (QE). This involves the central bank purchasing financial assets to inject liquidity into the financial system. Such measures aim to lower long-term interest rates, stimulate borrowing, and support economic recovery during challenging periods.

Communication and Forward Guidance

Effective communication is a cornerstone of USA’s monetary policy. The Fed provides regular statements and reports, offering insights into its decisions and economic outlook. Forward guidance, indicating the likely future path of interest rates, is a communication tool used to guide market expectations and influence economic behavior.

Global Considerations and Exchange Rates

The interconnected nature of the global economy means that USA’s monetary policy has implications beyond its borders. Changes in interest rates and monetary policies can influence exchange rates, impacting international trade and financial markets. The Fed must consider global economic conditions in its decision-making process.

Challenges in Achieving Policy Goals

Despite the Fed’s best efforts, challenges arise in achieving all aspects of its mandate simultaneously. Balancing the objectives of maximum employment, stable prices, and moderate long-term interest rates requires careful calibration, and external factors such as geopolitical events and global economic shifts can complicate the task.

Adapting to Economic Uncertainty

The ever-changing nature of the economy demands adaptability in monetary policy. The Fed must be agile in responding to unforeseen economic developments, whether they be recessions, pandemics, or other disruptions. Flexibility in approach is crucial to effectively navigate the dynamic economic landscape.

Looking to the Future: A Call for Economic Resilience

To explore innovative solutions at the intersection of USA’s Monetary Policy and Economic Stability, visit vexhibits.com. Navigating the complexities of monetary policy is an ongoing challenge that requires a combination of expertise, foresight, and adaptability. As the USA charts its economic course, the role of monetary policy remains integral to ensuring stability, promoting growth, and fostering resilience in the face of evolving economic landscapes.