Economic Consequences

Economic Effects of Transportation Regulation Changes

Economic Impact of Evolving Healthcare Laws

Introduction:

The intersection of healthcare and economics is a critical nexus that significantly influences the well-being of societies. This article delves into the intricate web of economic consequences arising from changes in healthcare laws, exploring how policy shifts can ripple through financial systems.

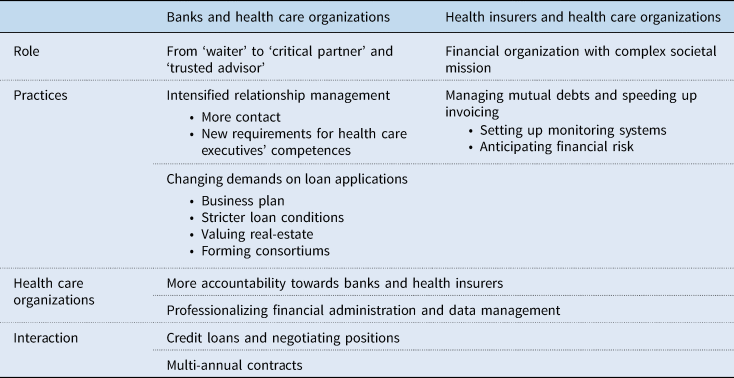

Financial Impact on Healthcare Institutions:

Changes in healthcare laws inevitably lead to a financial impact on healthcare institutions. Hospitals, clinics, and other providers must navigate evolving regulations, often requiring adjustments to operational structures and financial strategies to maintain stability.

Insurance Dynamics and Affordability:

One of the primary economic consequences involves the dynamics of health insurance. Alterations in healthcare laws can affect the affordability and accessibility of insurance plans. This, in turn, influences consumer spending patterns, impacting both individuals and the broader economy.

Innovation and Investment in Healthcare:

Healthcare laws play a pivotal role in shaping the landscape for innovation and investment in the medical field. Policy changes can either spur or hinder advancements, affecting not only the healthcare sector but also industries connected to medical research and technology.

Employer-Sponsored Healthcare and Labor Market Dynamics:

The economic ramifications extend to the employer-sponsored healthcare model. Changes in healthcare laws can influence labor market dynamics as businesses adjust to new compliance requirements, potentially impacting employment patterns and overall workforce management.

Public Health Initiatives and Government Expenditure:

Shifts in healthcare laws often coincide with adjustments in public health initiatives. Governments may need to reallocate resources, affecting public expenditure. Understanding the balance between public health priorities and economic considerations is crucial for sustainable policy development.

Pharmaceutical Industry and Drug Pricing:

The pharmaceutical industry is intricately linked to healthcare laws, particularly concerning drug pricing and market regulations. Changes in legislation can impact pharmaceutical companies’ profitability and influence the cost of medications for consumers, with wide-ranging economic implications.

Healthcare Access Disparities and Socioeconomic Factors:

Economic consequences also manifest in healthcare access disparities. Changes in healthcare laws can exacerbate or alleviate existing socioeconomic disparities in healthcare access, contributing to broader societal economic inequalities.

Technological Integration and Healthcare Costs:

Advancements in healthcare technology are often driven or hindered by legislative changes. The integration of new technologies can influence healthcare costs, posing challenges or opportunities for cost containment and efficiency within the healthcare system.

Investor Confidence in Healthcare Markets:

Investors closely monitor healthcare laws due to the substantial impact on the financial performance of healthcare-related companies. Changes in regulations can sway investor confidence, affecting market valuations and investment decisions within the healthcare sector.

Linking Economic Consequences to Informed Decision-Making:

For a comprehensive understanding of the economic consequences of changes in healthcare laws and strategies for informed decision-making, explore vexhibits.com. Delve into the nuances of healthcare policy impact on financial systems and discover ways to navigate these changes for economic resilience.

Conclusion:

In conclusion, the economic consequences of changes in healthcare laws are far-reaching, influencing healthcare institutions, insurance dynamics, innovation, labor markets, public health initiatives, pharmaceuticals, healthcare access, technology integration, and investor confidence. Navigating these complexities requires a nuanced approach, considering both the healthcare and economic aspects

Unraveling Economies: Political Instability’s Economic Consequences

Unraveling Economies: The Far-Reaching Effects of Political Instability

Political instability is a disruptive force that reverberates beyond the realm of governance, significantly impacting economic landscapes worldwide. This article explores the multifaceted economic consequences that unfold when political stability is compromised.

Trade Disruptions and Investment Uncertainty

One of the immediate economic consequences of political instability is the disruption of international trade. Uncertainty surrounding a nation’s political climate can deter foreign investments and lead to a decline in exports and imports. The unpredictability of policies and potential trade barriers create an environment where businesses hesitate to commit resources, hindering economic growth.

Currency Volatility and Inflationary Pressures

Political instability often translates into currency volatility, affecting exchange rates and triggering inflationary pressures. Investors may lose confidence in a nation’s currency, leading to depreciation. The ensuing inflation erodes the purchasing power of citizens, causing a ripple effect on consumer spending, business investments, and overall economic stability.

Impact on Foreign Direct Investment (FDI)

Foreign Direct Investment, a crucial driver of economic growth, is particularly sensitive to political stability. Countries facing political turmoil may experience a sharp decline in FDI, as investors seek safer and more predictable markets. This reduction in foreign investments hampers infrastructure development, job creation, and the overall economic progress of the nation.

Erosion of Public Trust and Consumer Confidence

Political instability erodes public trust and confidence in government institutions. This lack of trust extends to the economic sphere, affecting consumer confidence and spending behaviors. When citizens are uncertain about their country’s political future, they tend to cut back on non-essential expenses, leading to a slowdown in economic activity.

Government Spending and Fiscal Policy Challenges

Stable political environments enable governments to formulate and implement consistent fiscal policies. In times of political instability, the continuity of such policies becomes challenging. Governments may struggle to maintain fiscal discipline, leading to budgetary imbalances, increased public debt, and constraints on essential public services.

Social Unrest and Disruptions to Productive Activities

Political instability often manifests in social unrest and protests. These disturbances disrupt productive activities, causing a decline in productivity and economic output. Businesses may face challenges in maintaining regular operations, and the uncertainty may prompt some to relocate or scale back their activities.

Impact on Financial Markets and Investor Sentiment

Financial markets are highly responsive to political developments. Political instability introduces an element of uncertainty that can lead to increased market volatility. Investors may adopt a risk-averse stance, resulting in capital flight and a downturn in stock markets. The interconnectedness of global financial markets means that political turbulence in one region can have widespread consequences.

Long-Term Economic Stagnation and Development Setbacks

Persistent political instability can result in long-term economic stagnation. The inability to implement consistent economic policies, attract investments, and foster a conducive business environment hampers a nation’s development. The repercussions extend to education, healthcare, and infrastructure, impeding progress on multiple fronts.

International Repercussions and Global Economic Spillover

The economic consequences of political instability are not confined within national borders. Globalization means that disruptions in one country can