Financial planning

Budgeting Your Renovation Kitchen Remodeling Cost Breakdown

Budgeting Your Renovation: Kitchen Remodeling Cost Breakdown

Understanding the Basics

Embarking on a kitchen remodeling project can be an exciting yet daunting endeavor, especially when it comes to budgeting. Before diving into the renovation process, it’s essential to understand the basics of kitchen remodeling costs. This includes factors such as materials, labor, and additional expenses that may arise during the project.

Materials Matter

One of the most significant components of kitchen remodeling costs is materials. From cabinets and countertops to flooring and appliances, the materials you choose will have a significant impact on your overall budget. High-quality materials may come with a higher price tag upfront but can offer durability and longevity in the long run. Conversely, opting for more budget-friendly materials can help you save money but may require more frequent replacements or repairs down the line.

Labor Costs

In addition to materials, labor costs are another essential factor to consider when budgeting for your kitchen remodel. Labor costs can vary significantly depending on the complexity of the project, the skill level of the contractors, and your location. It’s essential to obtain multiple quotes from reputable contractors to ensure you’re getting a fair price for the work. Keep in mind that skilled labor may come at a higher cost, but it can also result in a higher quality end product.

Additional Expenses

In addition to materials and labor, there are several other expenses to factor into your kitchen remodeling budget. This includes permits and inspections, design fees, and any unexpected costs that may arise during the renovation process. It’s essential to set aside a contingency fund to cover these additional expenses and prevent budget overruns.

Cost-Saving Tips

While kitchen remodeling costs can add up quickly, there are several strategies you can employ to keep your budget in check. One cost-saving tip is to prioritize your must-have upgrades and splurge on items that will have the most significant impact on your kitchen’s functionality and aesthetics. Additionally, consider opting for more budget-friendly materials or exploring DIY options for tasks you feel comfortable tackling yourself.

Setting a Realistic Budget

Before embarking on your kitchen remodeling project, it’s crucial to set a realistic budget based on your financial situation and renovation goals. Take the time to research average costs for materials and labor in your area, and factor in any additional expenses you anticipate. Be sure to leave some wiggle room in your budget for unexpected costs or changes to the scope of the project.

Getting Quotes

Once you’ve established a budget for your kitchen remodel, it’s time to start getting quotes from contractors and suppliers. Be sure to provide detailed information about your project requirements and ask for itemized quotes that break down the costs of materials, labor, and any additional expenses. This will help you compare quotes more effectively and ensure you’re getting the best value for your money.

Making Informed Decisions

As you navigate the kitchen remodeling process, it’s essential to make informed decisions that align with your budget and

Optimizing Corporate Profits: Strategies for Success

Navigating the Terrain: Strategies for Optimizing Corporate Profits in the USA

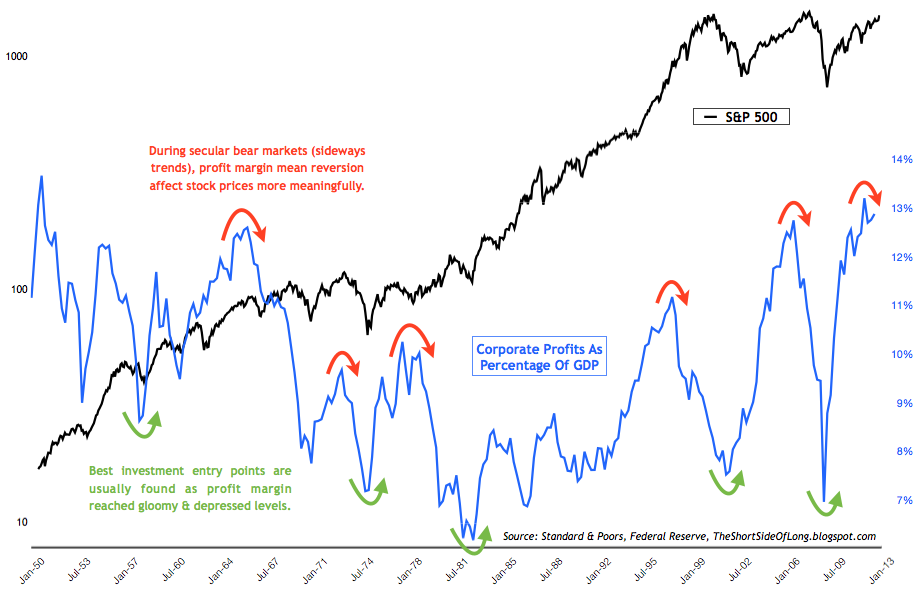

Corporate profits in the USA are a vital metric reflecting the financial health and success of businesses. This article delves into the intricacies of corporate profits, exploring strategies that companies employ to thrive in the competitive landscape.

Understanding Corporate Profits: Beyond the Bottom Line

Corporate profits encompass the net earnings of a business after deducting expenses. This financial metric serves as a barometer for a company’s performance and competitiveness. Understanding the components that contribute to corporate profits provides insights into the dynamics of a firm’s financial success.

Market Dynamics: Adapting to Competitive Realities

In a dynamic business environment, companies must navigate market forces to optimize their profits. This involves strategic positioning, effective marketing, and staying attuned to consumer trends. Companies that adapt swiftly to market dynamics are better positioned to capitalize on opportunities and enhance their profitability.

Operational Efficiency: Streamlining Processes for Success

Operational efficiency plays a pivotal role in maximizing corporate profits. Streamlining internal processes, reducing waste, and optimizing resource allocation contribute to cost savings. Companies that prioritize operational efficiency can allocate more resources to revenue-generating activities, positively impacting their bottom line.

Innovation and Product Development: Fuelling Profitable Growth

Innovative products and services are key drivers of corporate profits. Companies that invest in research and development, stay ahead of technological trends, and consistently bring innovative solutions to the market are positioned for sustained profitability. Innovation fosters differentiation and customer loyalty, contributing to long-term financial success.

Cost Management: Balancing Act for Financial Health

Effective cost management is a crucial aspect of optimizing corporate profits. This involves prudent expense control, negotiating favorable supplier agreements, and exploring opportunities for cost-sharing or outsourcing. Striking a balance between cost reduction and maintaining quality is paramount for sustainable financial health.

Global Expansion: Tapping into International Markets

Many successful companies optimize their profits by expanding beyond domestic borders. International markets offer new opportunities for revenue generation. However, global expansion requires careful consideration of cultural nuances, regulatory landscapes, and competitive dynamics. Companies that navigate these complexities effectively can unlock new avenues for profit growth.

Financial Planning and Investment: Strategic Allocation of Resources

Strategic financial planning and investment are instrumental in optimizing corporate profits. Companies must allocate resources judiciously, considering both short-term financial goals and long-term sustainability. Prudent investment decisions, whether in technology, infrastructure, or talent, contribute to enhanced profitability over time.

Corporate Social Responsibility (CSR): Balancing Profit and Purpose

In the modern business landscape, corporate social responsibility (CSR) is increasingly intertwined with profitability. Companies that actively engage in socially responsible practices often enjoy enhanced brand reputation, customer loyalty, and employee satisfaction. Balancing profit goals with a commitment to social and environmental responsibility is a strategy for sustained success.

Visit Corporate Profits in the USA for In-Depth Insights

For those seeking in-depth insights into optimizing corporate profits in the USA, visit Corporate Profits in the USA. The curated analysis and information provided can empower businesses with the knowledge needed to navigate the intricacies of profit optimization

Building Economic Resilience: Strategies for Adaptation

Building Economic Resilience: Strategies for Adaptation

The global economic landscape is continually evolving, shaped by various challenges and disruptions. In this exploration, we delve into the concept of economic resilience and unveil strategies that businesses and economies can employ to adapt and thrive in an ever-changing environment.

Understanding Economic Resilience

Economic resilience is the capacity of a system to absorb shocks, adapt to changing circumstances, and maintain functionality. It goes beyond mere survival; it involves bouncing back from setbacks and evolving stronger in the face of challenges. Understanding the fundamentals of economic resilience is crucial for businesses and policymakers alike.

Diversification of Revenue Streams

One key strategy for economic resilience is the diversification of revenue streams. Overreliance on a single source of income can make businesses vulnerable to economic downturns or industry-specific challenges. Diversifying revenue streams involves expanding product lines, entering new markets, or exploring innovative business models to create a more robust and adaptable financial structure.

Investment in Technology and Innovation

Technological advancements are catalysts for economic resilience. Investing in technology not only enhances operational efficiency but also positions businesses to adapt to changing market demands. Embracing innovation allows companies to stay ahead of the curve, offering products and services that align with evolving consumer preferences and market trends.

Adaptable Supply Chain Management

The COVID-19 pandemic highlighted the importance of supply chain resilience. Businesses that adapt their supply chain management strategies to be more flexible and responsive can better navigate disruptions. This may involve diversifying suppliers, embracing digital technologies for real-time tracking, and maintaining strategic reserves to cushion against unforeseen events.

Focus on Sustainable Practices

Sustainability is integral to economic resilience. Adopting environmentally friendly and socially responsible practices not only contributes to a healthier planet but also enhances long-term business viability. Consumers increasingly favor sustainable businesses, making it a strategic move for economic adaptation and resilience.

Financial Planning and Risk Management

Effective financial planning and risk management are fundamental to economic resilience. Businesses and governments need to create robust financial plans that account for uncertainties. This includes managing debt responsibly, building contingency funds, and implementing risk mitigation strategies to weather economic storms.

Investment in Workforce Development

A skilled and adaptable workforce is a cornerstone of economic resilience. Investing in workforce development ensures that employees have the skills needed to navigate changes in the business landscape. This may involve providing training programs, fostering a culture of continuous learning, and prioritizing employee well-being.

Policy Frameworks and Government Support

Governments play a pivotal role in fostering economic resilience. Implementing supportive policy frameworks, offering incentives for innovation, and creating an environment conducive to business growth are crucial. Government support during challenging times, such as financial assistance programs, can provide a safety net for businesses and stimulate economic recovery.

Crisis Communication and Reputation Management

Maintaining trust and credibility is paramount for economic resilience. Effective crisis communication and reputation management strategies help businesses navigate challenging situations without significant damage to their brand. Transparent communication and proactive measures build resilience by fostering stakeholder trust.

Global Collaboration