Global impact

Navigating Federal Reserve Policies: Impacts on Economy

Deciphering the Impact: Navigating Federal Reserve Policies

Understanding the intricacies of Federal Reserve policies is paramount for individuals, businesses, and investors. This article delves into the role of the Federal Reserve and the far-reaching impacts of its policies on the economy.

The Federal Reserve: A Pillar of Economic Stability

The Federal Reserve, often referred to as the Fed, is the United States’ central banking system. Charged with fostering economic stability and maintaining the health of the financial system, the Fed plays a pivotal role in shaping the nation’s economic landscape.

Monetary Policy: The Fed’s Tool for Economic Management

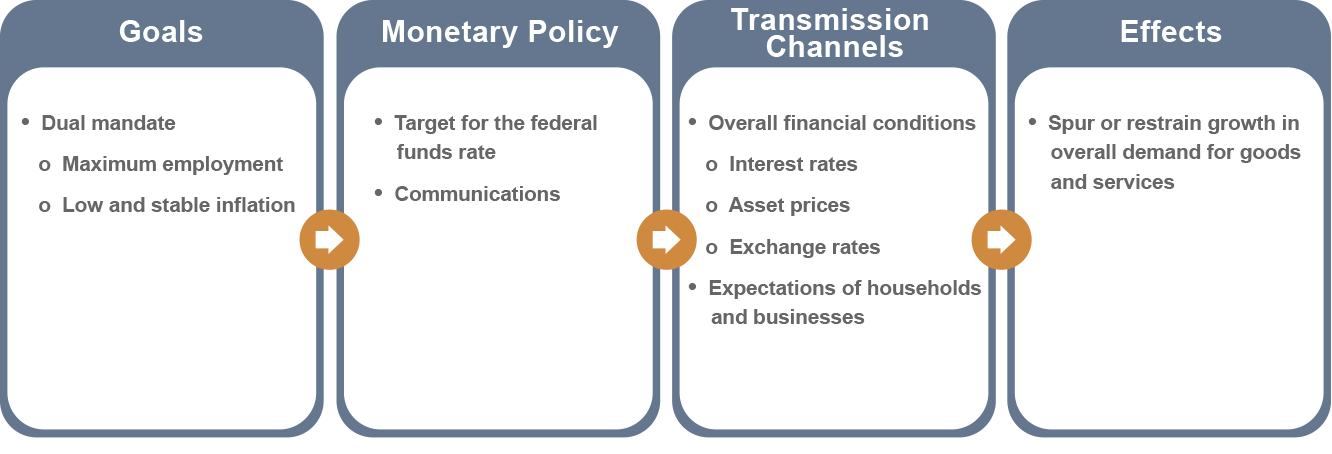

At the heart of Federal Reserve policies is monetary policy, a strategic toolkit used to regulate the money supply and interest rates. By adjusting these levers, the Fed aims to influence inflation, employment, and overall economic growth. Analyzing monetary policy decisions provides insights into the Fed’s outlook on the economy.

Interest Rates and Their Ripple Effect: A Delicate Balance

One of the primary instruments in the Fed’s arsenal is the management of interest rates. Changes in interest rates have a cascading impact on borrowing costs, spending, and investment. Understanding the delicate balance the Fed maintains in adjusting interest rates is key to anticipating economic shifts.

Quantitative Easing: Unconventional Measures in Extraordinary Times

In times of economic turbulence, the Federal Reserve may employ unconventional measures like quantitative easing. This involves purchasing financial assets to inject liquidity into the economy. Examining the use of quantitative easing provides a lens into the Fed’s response to crises and its efforts to spur economic activity.

Inflation Targeting: Striving for Stability

Maintaining stable prices is a core objective of the Federal Reserve. The Fed sets an inflation target to guide its monetary policy decisions. Striking the right balance between fostering economic growth and preventing runaway inflation requires meticulous analysis and strategic policymaking.

Employment Goals: Fostering a Robust Job Market

Alongside its focus on inflation, the Federal Reserve is committed to promoting maximum employment. Monitoring employment goals involves assessing the health of the job market and making policy adjustments to support job creation. The Fed’s actions in this regard have far-reaching implications for workers and businesses.

Communication Strategies: Guiding Expectations

The Federal Reserve places considerable emphasis on clear communication of its policies and intentions. Transparent communication helps shape expectations in financial markets and among the public. Scrutinizing the language used in Federal Reserve statements provides valuable insights into its stance on economic conditions and potential future actions.

Global Impact: The Fed’s Reach Beyond Borders

The Federal Reserve’s policies extend beyond national boundaries, influencing global financial markets. Changes in interest rates and monetary policies can trigger shifts in currency values and impact international trade. Understanding the global implications of Federal Reserve actions is essential for businesses operating in an interconnected world.

Challenges and Criticisms: Navigating a Complex Landscape

While the Federal Reserve plays a crucial role in stabilizing the economy, its policies are not without challenges and criticisms. Balancing competing economic objectives, potential market distortions, and concerns about excessive intervention