Economic stability

Navigating Unemployment Rate Trends: Insights for Today’s Economy

Deciphering Unemployment Rate Trends: A Comprehensive Analysis

Understanding the nuances of unemployment rate trends is crucial in navigating the complex terrain of today’s economy. This article delves into the intricacies of this economic indicator, shedding light on its impact and providing insights for individuals and policymakers alike.

The Unemployment Rate Unveiled: Defining the Metric

The unemployment rate is a key economic indicator that reflects the percentage of the labor force without employment. This metric serves as a thermometer for the job market, providing a snapshot of economic health. Examining its trends allows for a deeper understanding of the dynamics shaping the workforce landscape.

Historical Perspectives: Tracing the Evolution of Unemployment

To comprehend the present, it is essential to glance back at the historical context of unemployment rate trends. Examining patterns over time reveals the resilience of economies in overcoming challenges and adapting to changing circumstances. Historical perspectives offer valuable insights for shaping effective policies and responses.

Economic Downturns and Surges: Unraveling Cause and Effect

Unemployment rate trends often mirror economic downturns and surges. During times of recession, the rate tends to rise as businesses cut costs and reduce their workforce. Conversely, economic upturns see a decline in unemployment as businesses expand, creating more job opportunities. Understanding this cause-and-effect relationship is crucial for anticipating economic shifts.

Impact on Communities: Beyond Numbers to Real Lives

Behind every unemployment rate is a human story. The impact of job loss extends beyond statistical figures, affecting individuals, families, and entire communities. Exploring the human aspect of unemployment emphasizes the importance of proactive measures to mitigate its effects, such as job training programs and social support systems.

Government Policies and Interventions: Balancing Act for Stability

Policymakers play a pivotal role in influencing unemployment rate trends through economic interventions. Government policies, such as fiscal stimulus packages and job creation initiatives, aim to stabilize the job market during challenging times. Analyzing the effectiveness of these interventions is crucial for shaping future economic strategies.

Global Influences: Unemployment in a Connected World

In an era of globalization, unemployment rate trends are not isolated within national borders. Global economic factors, trade relationships, and geopolitical events can have a significant impact on local job markets. Understanding these interconnected influences provides a more comprehensive view for policymakers and businesses alike.

Technological Advancements: Shaping the Future of Employment

The rise of technology introduces a dynamic element to unemployment rate trends. Automation, artificial intelligence, and evolving job requirements contribute to a shifting employment landscape. Adapting to these changes requires forward-thinking strategies to ensure the workforce remains equipped with the skills demanded by emerging industries.

Education and Skill Development: Building Resilience

In the face of evolving employment trends, education and skill development become paramount. Empowering individuals with the right skills not only enhances their employability but also contributes to overall economic resilience. Investments in education and training programs play a crucial role in aligning the workforce with the demands of a rapidly changing job market.

Charting the Course Forward: Utilizing Insights for Progress

As we navigate

Navigating Federal Reserve Policies: Impacts on Economy

Deciphering the Impact: Navigating Federal Reserve Policies

Understanding the intricacies of Federal Reserve policies is paramount for individuals, businesses, and investors. This article delves into the role of the Federal Reserve and the far-reaching impacts of its policies on the economy.

The Federal Reserve: A Pillar of Economic Stability

The Federal Reserve, often referred to as the Fed, is the United States’ central banking system. Charged with fostering economic stability and maintaining the health of the financial system, the Fed plays a pivotal role in shaping the nation’s economic landscape.

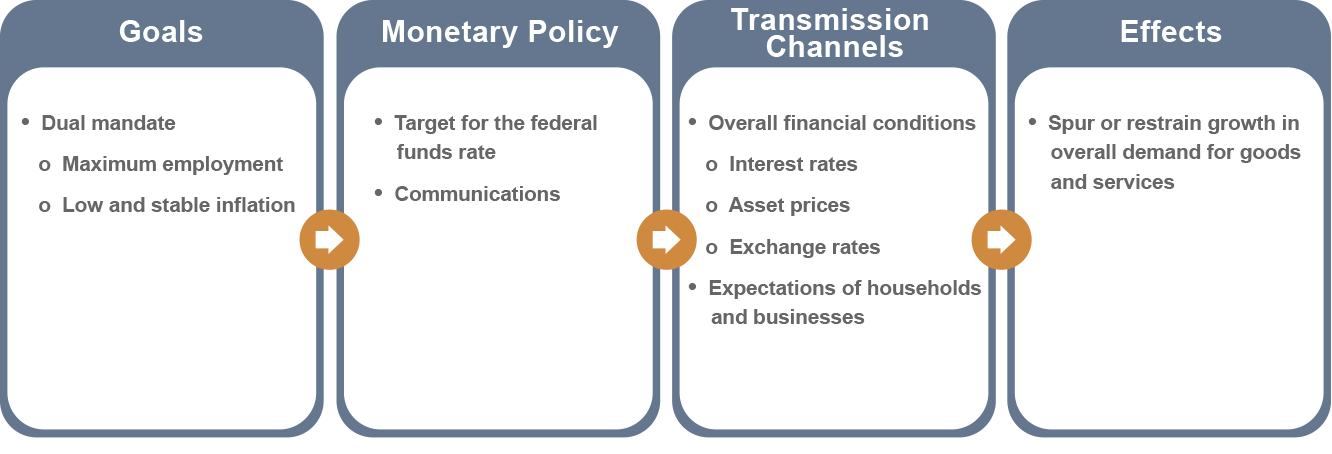

Monetary Policy: The Fed’s Tool for Economic Management

At the heart of Federal Reserve policies is monetary policy, a strategic toolkit used to regulate the money supply and interest rates. By adjusting these levers, the Fed aims to influence inflation, employment, and overall economic growth. Analyzing monetary policy decisions provides insights into the Fed’s outlook on the economy.

Interest Rates and Their Ripple Effect: A Delicate Balance

One of the primary instruments in the Fed’s arsenal is the management of interest rates. Changes in interest rates have a cascading impact on borrowing costs, spending, and investment. Understanding the delicate balance the Fed maintains in adjusting interest rates is key to anticipating economic shifts.

Quantitative Easing: Unconventional Measures in Extraordinary Times

In times of economic turbulence, the Federal Reserve may employ unconventional measures like quantitative easing. This involves purchasing financial assets to inject liquidity into the economy. Examining the use of quantitative easing provides a lens into the Fed’s response to crises and its efforts to spur economic activity.

Inflation Targeting: Striving for Stability

Maintaining stable prices is a core objective of the Federal Reserve. The Fed sets an inflation target to guide its monetary policy decisions. Striking the right balance between fostering economic growth and preventing runaway inflation requires meticulous analysis and strategic policymaking.

Employment Goals: Fostering a Robust Job Market

Alongside its focus on inflation, the Federal Reserve is committed to promoting maximum employment. Monitoring employment goals involves assessing the health of the job market and making policy adjustments to support job creation. The Fed’s actions in this regard have far-reaching implications for workers and businesses.

Communication Strategies: Guiding Expectations

The Federal Reserve places considerable emphasis on clear communication of its policies and intentions. Transparent communication helps shape expectations in financial markets and among the public. Scrutinizing the language used in Federal Reserve statements provides valuable insights into its stance on economic conditions and potential future actions.

Global Impact: The Fed’s Reach Beyond Borders

The Federal Reserve’s policies extend beyond national boundaries, influencing global financial markets. Changes in interest rates and monetary policies can trigger shifts in currency values and impact international trade. Understanding the global implications of Federal Reserve actions is essential for businesses operating in an interconnected world.

Challenges and Criticisms: Navigating a Complex Landscape

While the Federal Reserve plays a crucial role in stabilizing the economy, its policies are not without challenges and criticisms. Balancing competing economic objectives, potential market distortions, and concerns about excessive intervention