monetary policy

Navigating Federal Reserve Policies: Impacts on Economy

Deciphering the Impact: Navigating Federal Reserve Policies

Understanding the intricacies of Federal Reserve policies is paramount for individuals, businesses, and investors. This article delves into the role of the Federal Reserve and the far-reaching impacts of its policies on the economy.

The Federal Reserve: A Pillar of Economic Stability

The Federal Reserve, often referred to as the Fed, is the United States’ central banking system. Charged with fostering economic stability and maintaining the health of the financial system, the Fed plays a pivotal role in shaping the nation’s economic landscape.

Monetary Policy: The Fed’s Tool for Economic Management

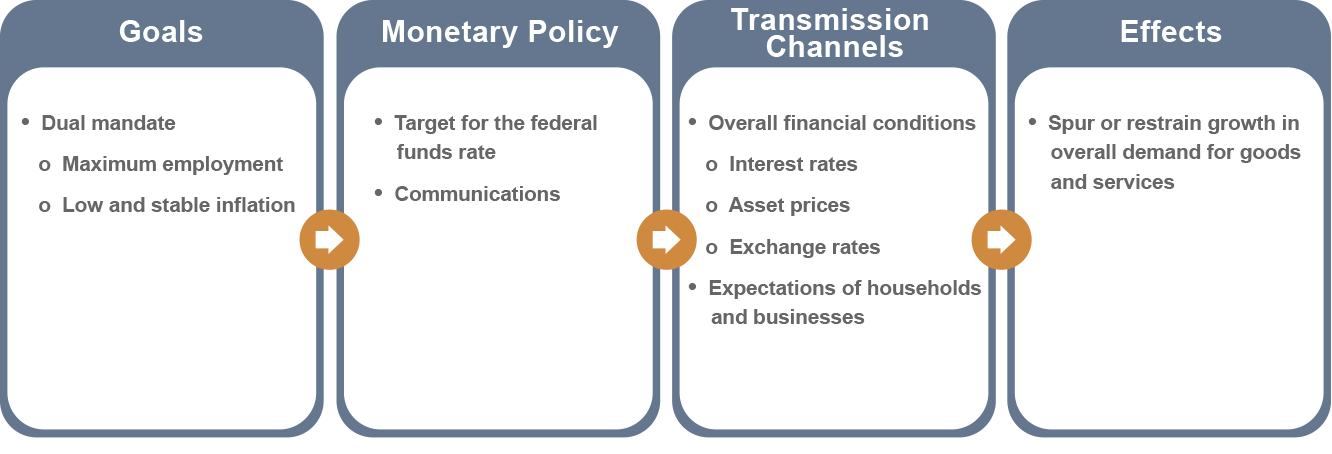

At the heart of Federal Reserve policies is monetary policy, a strategic toolkit used to regulate the money supply and interest rates. By adjusting these levers, the Fed aims to influence inflation, employment, and overall economic growth. Analyzing monetary policy decisions provides insights into the Fed’s outlook on the economy.

Interest Rates and Their Ripple Effect: A Delicate Balance

One of the primary instruments in the Fed’s arsenal is the management of interest rates. Changes in interest rates have a cascading impact on borrowing costs, spending, and investment. Understanding the delicate balance the Fed maintains in adjusting interest rates is key to anticipating economic shifts.

Quantitative Easing: Unconventional Measures in Extraordinary Times

In times of economic turbulence, the Federal Reserve may employ unconventional measures like quantitative easing. This involves purchasing financial assets to inject liquidity into the economy. Examining the use of quantitative easing provides a lens into the Fed’s response to crises and its efforts to spur economic activity.

Inflation Targeting: Striving for Stability

Maintaining stable prices is a core objective of the Federal Reserve. The Fed sets an inflation target to guide its monetary policy decisions. Striking the right balance between fostering economic growth and preventing runaway inflation requires meticulous analysis and strategic policymaking.

Employment Goals: Fostering a Robust Job Market

Alongside its focus on inflation, the Federal Reserve is committed to promoting maximum employment. Monitoring employment goals involves assessing the health of the job market and making policy adjustments to support job creation. The Fed’s actions in this regard have far-reaching implications for workers and businesses.

Communication Strategies: Guiding Expectations

The Federal Reserve places considerable emphasis on clear communication of its policies and intentions. Transparent communication helps shape expectations in financial markets and among the public. Scrutinizing the language used in Federal Reserve statements provides valuable insights into its stance on economic conditions and potential future actions.

Global Impact: The Fed’s Reach Beyond Borders

The Federal Reserve’s policies extend beyond national boundaries, influencing global financial markets. Changes in interest rates and monetary policies can trigger shifts in currency values and impact international trade. Understanding the global implications of Federal Reserve actions is essential for businesses operating in an interconnected world.

Challenges and Criticisms: Navigating a Complex Landscape

While the Federal Reserve plays a crucial role in stabilizing the economy, its policies are not without challenges and criticisms. Balancing competing economic objectives, potential market distortions, and concerns about excessive intervention

Shaping Prosperity: Government Economic Policies

Crafting Economic Futures: Understanding Government Economic Policies

Governments play a pivotal role in shaping the economic landscape through a variety of policies. This article delves into the complexities and impacts of government economic policies, exploring the key areas where policy decisions influence the prosperity and well-being of nations.

Monetary Policy: The Central Bank’s Toolbox

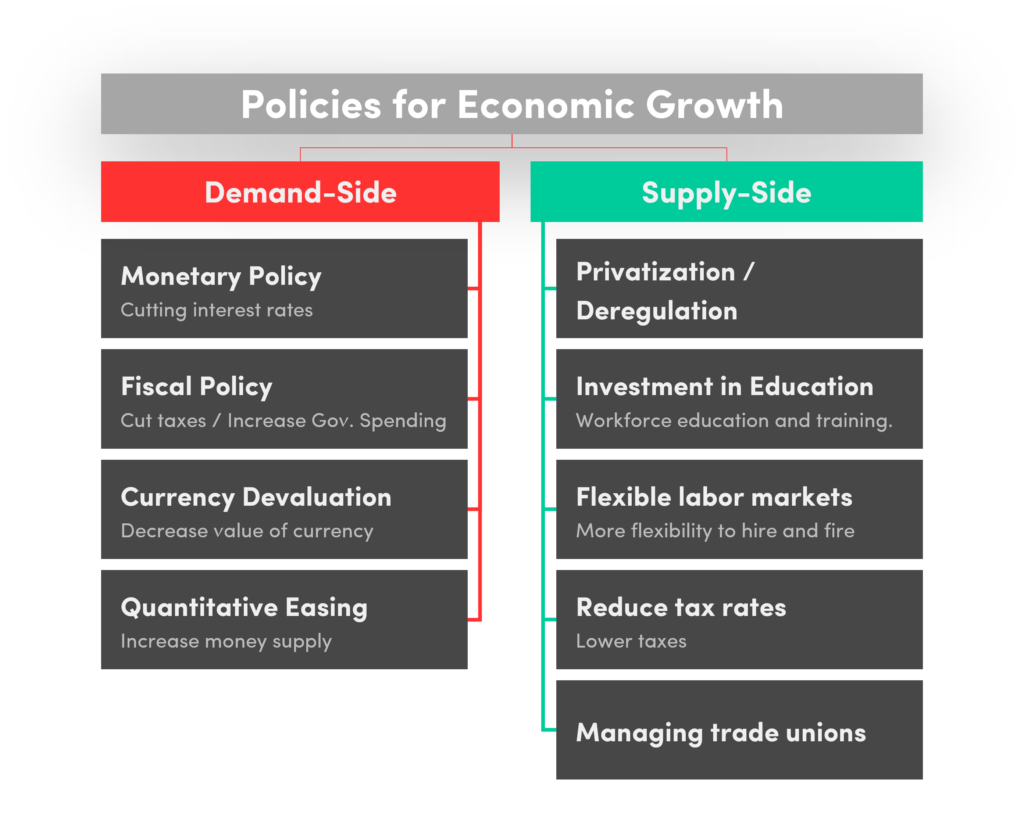

One of the primary tools in a government’s economic policy arsenal is monetary policy, typically executed by the central bank. Through actions like setting interest rates and influencing money supply, monetary policy aims to regulate inflation, employment, and overall economic stability. Understanding the intricacies of monetary policy provides insights into a nation’s economic direction.

Fiscal Policy: Government Spending and Taxation

Fiscal policy involves the government’s use of spending and taxation to influence the economy. During economic downturns, governments may increase spending or cut taxes to stimulate growth, while during periods of expansion, they may reduce spending or raise taxes to prevent overheating. Analyzing fiscal policy decisions unveils the government’s economic priorities.

Trade Policies: Navigating Global Economic Relationships

In an interconnected world, trade policies play a crucial role in shaping a nation’s economic relationships. Governments implement trade agreements, tariffs, and trade restrictions to protect domestic industries, foster international trade, and maintain a competitive edge. Understanding the nuances of trade policies is vital for businesses and investors navigating the global market.

Labor Market Regulations: Balancing Worker Protections and Flexibility

Government policies regarding the labor market can significantly impact employment dynamics. Regulations on minimum wage, working hours, and employee rights aim to protect workers, but they can also influence hiring practices and business operations. Examining the balance between worker protections and business flexibility sheds light on the overall economic environment.

Taxation Policies: Influencing Economic Behavior

Tax policies are powerful instruments for governments to influence economic behavior. From corporate taxes to individual income taxes, policy decisions can impact investment, spending, and saving patterns. Understanding the goals and implications of taxation policies is crucial for businesses and individuals navigating the fiscal landscape.

Environmental Policies: Sustainable Development Initiatives

As environmental concerns gain prominence, governments are increasingly implementing policies to promote sustainable development. From emissions regulations to renewable energy incentives, environmental policies influence industries’ practices and consumer choices. Analyzing these policies provides insights into a government’s commitment to environmental stewardship.

Innovation and Technology Policies: Fostering Growth and Competitiveness

Governments often invest in policies aimed at fostering innovation and technological advancements. Research and development incentives, patent protections, and support for emerging industries contribute to a nation’s competitiveness in the global market. Exploring innovation policies unveils a government’s strategy for long-term economic growth.

Social Welfare Policies: Addressing Inequality and Well-being

Social welfare policies, including healthcare, education, and social safety nets, play a vital role in promoting societal well-being and addressing inequality. Government decisions in these areas impact access to essential services and contribute to the overall quality of life for citizens. Understanding social welfare policies is integral to assessing a government’s commitment to societal welfare.

Visit Government Economic Policies for In-Depth Insights

For a comprehensive

Navigating USA’s Inflation Landscape: Trends and Implications

Decoding the Complexities of Inflation Rate in the USA

Understanding the nuances of inflation rate trends is essential for individuals, businesses, and policymakers navigating the economic landscape. This article delves into the intricacies of inflation in the USA, shedding light on its trends and implications.

Defining Inflation: The Economic Phenomenon

Inflation refers to the sustained increase in the general price level of goods and services over time. While moderate inflation is a normal part of a healthy economy, excessive inflation or deflation can have far-reaching consequences. Monitoring inflation rates is crucial for maintaining economic stability.

Factors Influencing Inflation: Unraveling the Web

Several factors contribute to inflationary pressures. Demand-pull inflation occurs when demand for goods and services surpasses their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs, such as increased wages or commodity prices. Understanding these dynamics helps in predicting inflationary trends.

The Role of Monetary Policy: Managing Inflation

Central banks, including the Federal Reserve in the USA, play a pivotal role in managing inflation. Through monetary policy tools like interest rates and open market operations, central banks aim to control inflation and stabilize the economy. Observing the actions of central banks provides insights into their stance on inflation management.

Consumer Price Index (CPI): A Key Metric

The Consumer Price Index (CPI) is a widely used indicator for tracking inflation. It measures the average change in prices paid by consumers for a basket of goods and services. An increasing CPI indicates rising inflation. Analyzing CPI trends allows individuals and businesses to gauge the impact on their purchasing power.

Inflation and Investments: Navigating the Impact

Inflation has significant implications for investments. While moderate inflation erodes the real value of money, hyperinflation can devastate savings. Investors often seek assets that provide a hedge against inflation, such as real estate, commodities, or Treasury Inflation-Protected Securities (TIPS). Strategically diversifying portfolios is key to mitigating the impact of inflation on investments.

Wage Growth and Inflation: Balancing Act

Wage growth is a crucial element in the inflation puzzle. When wages rise at a pace similar to or higher than inflation, consumers maintain their purchasing power. However, if wages lag behind inflation, individuals experience a decline in real income. Examining the relationship between wage growth and inflation offers insights into economic health.

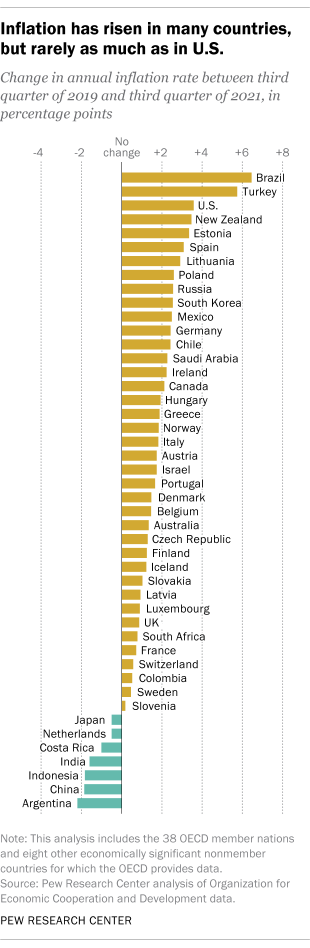

Global Influences on Inflation: A Connected World

In an era of globalization, the USA’s inflation rate is influenced by global economic dynamics. Fluctuations in commodity prices, international trade relationships, and geopolitical events can impact inflation. Understanding these global influences provides a more comprehensive view for policymakers and businesses alike.

Inflation Expectations: Shaping Economic Behavior

Expectations of future inflation can influence present economic behavior. If individuals and businesses anticipate rising prices, they may adjust spending and investment patterns. Central banks closely monitor inflation expectations as they strive to anchor them at levels consistent with their inflation targets.

Strategies for Inflationary Environments: A Pragmatic Approach

Inflationary environments require individuals and businesses to adopt pragmatic strategies. These may include negotiating fixed-price

Navigating Financial Waters: Interest Rates in the USA

Decoding Economic Signposts: Interest Rates in the USA

Understanding interest rates in the USA is pivotal for both financial markets and everyday consumers. This article explores the multifaceted aspects of interest rates, their role in the economy, and the impact they have on various sectors.

Fundamentals of Interest Rates: The Building Blocks

Interest rates represent the cost of borrowing money or the return on investment. Controlled by central banks, they serve as a lever for economic management. Analyzing the fundamental principles of interest rates provides a foundation for grasping their broader implications.

Central Bank Dynamics: The Federal Reserve’s Role

The Federal Reserve, the USA’s central bank, plays a central role in setting and influencing interest rates. Through mechanisms like the federal funds rate, the Fed regulates borrowing costs and shapes monetary policy. Understanding the dynamics of the Federal Reserve is crucial for interpreting interest rate movements.

Economic Indicators: Interest Rates as Barometers

Interest rates act as barometers for economic health. The Federal Reserve adjusts rates based on economic indicators such as inflation, employment, and GDP growth. Examining how interest rates respond to these indicators provides insights into the overall economic climate.

Consumer Impact: Borrowing Costs and Spending Habits

For consumers, interest rates directly influence borrowing costs. Whether obtaining a mortgage, car loan, or using credit cards, changes in interest rates impact spending and saving habits. Monitoring interest rate trends allows individuals to make informed financial decisions.

Business Investments: Capitalizing on Rate Environments

Interest rates influence corporate decisions on investments and expansions. Lower rates may encourage businesses to borrow for growth, while higher rates may lead to more conservative financial strategies. Analyzing the relationship between interest rates and business investments provides a glimpse into economic vitality.

Real Estate Dynamics: Mortgages and Property Markets

The real estate sector is particularly sensitive to interest rate fluctuations. Mortgage rates, influenced by broader interest rate trends, impact homebuyers’ affordability. Understanding how interest rates affect real estate dynamics is crucial for homeowners, buyers, and industry professionals.

Stock Market Reactions: Investors’ Sentiment and Strategies

Interest rates play a significant role in shaping investors’ sentiment in the stock market. As rates change, stock prices may respond accordingly. Investors often adjust their portfolios based on interest rate expectations, making the analysis of this relationship integral for investment decisions.

Inflationary Pressures: Balancing Act for Monetary Policy

Interest rates also serve as a tool to control inflation. By adjusting rates, central banks aim to strike a balance between stimulating economic growth and preventing excessive inflation. Examining how interest rates contribute to this delicate balancing act provides insights into monetary policy.

Global Influences: Interest Rates in a Connected World

Interest rates in the USA have implications beyond its borders. Global economic interconnectedness means that rate changes can affect international trade, currency values, and financial markets worldwide. Understanding the global influences on interest rates is crucial for businesses and policymakers.

Visit Interest Rates in the USA for In-Depth Insights

For a comprehensive exploration of interest rates in the USA, visit Interest Rates in

Become A Foreign Exchange Master With These Tips

Supplemental income can help make ends meet. There are millions out there looking for some sort of financial relief. If you have been thinking about earning some more money by trading on the forex market, here is some information you should read.

Forex depends on economic conditions far more than stock market options. Before engaging in Foreign Exchange trades, learn about trade imbalances, fiscal and monetary policy, fiscal and monetary policy. Trading without understanding these important factors is a surefire way to lose money.

Trading should never be emotional decisions.

Other emotions to control include panic and panic.

Use margin wisely to keep your profits secure. Margin can boost your profits. If you do not pay attention, however, you can lose more than any potential gains. Margin should be used when you feel comfortable in your financial position and there is overall little risk of a shortfall.

Using demos to learn is a virtual demo account gives you the advantage of learning to trade using real market conditions without using real money. There are lots of online forex tutorials of which you understand the basics.

Don’t find yourself in a large number of markets than you are a beginner. This will just get you and possibly cause confused or frustrated.

Foreign Exchange

Don’t think that you’re going to go into Foreign Exchange trading on forex. The best Foreign Exchange traders have been analyzing for many years.The odds of you randomly discovering an untried but successful strategy are vanishingly small. Do some research and stick to what works.

Do not put yourself in the same position. Opening in the same size position each time may cost forex traders money or over committed with their money.

Placing stop losses in the Foreign Exchange market is more artistic when applied to Foreign Exchange. A trader needs to know how to balance between the technical part of it and natural instincts. It takes a lot of trial and error to master stop losses.

New foreign exchange traders get excited when it comes to trading and pour themselves into it wholeheartedly. You can probably only focus well for a couple of hours before it’s break time.

Learn to read market signals and draw your own conclusions. This is the best way for you can be successful within the profits that you want.

Most successful foreign exchange traders will advice you to keep a journal of journals. Write down all of your triumphs and failures. This will help you to examine your results over time and continue using strategies that have worked in the past.

Trading against the market should never be attempted by a beginner, and even the most experienced traders should not try to do it.

One strategy all forex traders should know as a Forex trader is when to pull out. This will lose you money in the long run.

Try to avoid buying and selling in too many markets at the same time. The major currency pair are appropriate for a good …