DebtManagement

Balancing Act: Navigating US Fiscal Policy Challenges

Balancing Act: Navigating US Fiscal Policy Challenges

As the United States continues to navigate complex economic landscapes, its fiscal policy plays a pivotal role in shaping the nation’s financial trajectory. This article delves into the intricate web of challenges and considerations involved in managing US fiscal policy and the implications for economic stability and growth.

Foundation of Economic Management

US fiscal policy, often overseen by government agencies and policymakers, forms the foundation of economic management. It involves decisions related to taxation, government spending, and borrowing, collectively influencing the overall economic health of the nation. Striking the right balance in these areas is crucial for maintaining stability and fostering sustainable economic growth.

The Dual Role of Fiscal Policy

Fiscal policy serves a dual role in economic management. During periods of economic downturn, the government may implement expansionary fiscal policies, such as tax cuts and increased spending, to stimulate economic activity. Conversely, during times of overheating and inflationary pressures, contractionary fiscal policies may be employed to cool down the economy. This delicate dance requires precision to avoid unintended consequences.

Taxation Strategies and Economic Impact

One of the key components of US fiscal policy is taxation. Decisions related to tax rates, deductions, and credits have direct implications for businesses and individuals. Striking a balance between providing necessary government revenue and avoiding stifling economic activity is a constant challenge. Effective tax policies aim to encourage investment, job creation, and overall economic prosperity.

Government Spending Priorities

Determining government spending priorities is a critical aspect of fiscal policy. Allocation of funds to areas such as infrastructure, education, healthcare, and defense reflects national priorities. Striking a balance between addressing immediate needs and making long-term investments is essential. Efficient and targeted government spending can spur economic growth, create jobs, and enhance the overall well-being of the population.

Debt Management and Fiscal Responsibility

Managing the national debt is a perpetual challenge within the realm of fiscal policy. While borrowing can be a tool for financing essential initiatives, an unsustainable debt burden can lead to economic instability. Striking a balance between leveraging debt for strategic investments and ensuring fiscal responsibility is essential to avoid long-term economic consequences.

Global Economic Considerations

The interconnectedness of the global economy adds another layer of complexity to US fiscal policy. Economic decisions made in the United States have ripple effects worldwide. Coordinating fiscal policies with international economic conditions is crucial for maintaining stability and fostering collaborative solutions to global challenges.

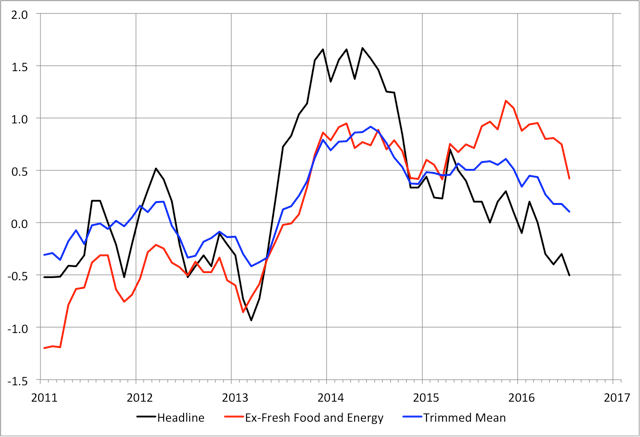

Inflationary Pressures and Monetary Policy Coordination

Balancing fiscal policy with monetary policy is vital for economic stability. Inflationary pressures, influenced by fiscal decisions, require coordination with the Federal Reserve’s monetary policies. Effective collaboration ensures a harmonized approach to managing interest rates, money supply, and overall economic conditions.

Challenges in Times of Crisis

During times of crisis, such as a recession or a global pandemic, the challenges facing US fiscal policy become more pronounced. Rapid response mechanisms, such as stimulus packages and targeted interventions, must be deployed to mitigate economic downturns. Striking the right balance between