GovernmentSpending

Weathering Calamity: Economic Impact of Natural Disasters

Weathering Calamity: Economic Impact of Natural Disasters

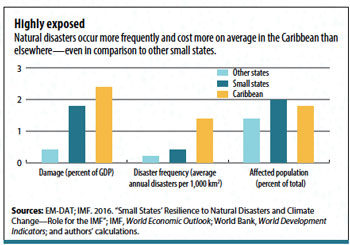

Natural disasters have the power to reshape landscapes and communities, leaving a profound and lasting impact on economies worldwide. In this exploration, we delve into the intricate web of consequences that unfold when nature’s fury collides with economic systems.

The Immediate Toll on Infrastructure

Natural disasters, be they hurricanes, earthquakes, or floods, wreak havoc on infrastructure. Roads, bridges, and utilities are often damaged or destroyed, disrupting transportation and communication networks. The immediate economic toll involves the costs of emergency response, rescue operations, and the subsequent need for reconstruction. These impacts strain local and national economies, diverting resources from other essential areas.

Disruption to Businesses and Supply Chains

The economic repercussions of natural disasters extend to businesses and supply chains. Disruptions in manufacturing, distribution, and transportation impede the flow of goods and services. Businesses may face closures, production halts, and supply shortages, leading to financial losses. The interconnectedness of the global economy means that disruptions in one region can have ripple effects throughout the supply chain.

Job Losses and Unemployment

The aftermath of natural disasters often brings about job losses and increased unemployment. Businesses forced to shut down or scale back operations may lay off workers, contributing to a sudden spike in unemployment rates. This not only impacts individuals and families but also poses challenges for the broader economy as consumer spending decreases, further dampening economic activity.

Insurance Costs and Financial Strain

The economic impact of natural disasters extends to the insurance industry, which faces substantial claims for property damage and loss. The surge in claims can lead to increased insurance costs for individuals and businesses, putting financial strain on both. In some cases, the rising costs may lead to insurance unavailability, leaving communities vulnerable to future disasters.

Government Spending and Fiscal Challenges

Governments bear a significant economic burden in the aftermath of natural disasters. Emergency response efforts, infrastructure rebuilding, and assistance to affected communities require substantial financial resources. The strain on public finances can lead to budgetary deficits, increased debt, or the reallocation of funds from other essential services, creating long-term fiscal challenges.

Impact on Agriculture and Food Security

Natural disasters can devastate agricultural sectors, affecting food production and supply. Crop and livestock losses contribute to food shortages, leading to increased prices and food insecurity. The agricultural fallout also impacts the livelihoods of farmers, creating a ripple effect on rural economies and exacerbating economic challenges in already vulnerable regions.

Tourism and Economic Downturn

Regions heavily dependent on tourism often experience a sharp economic downturn following natural disasters. Damage to attractions, infrastructure, and the overall perception of safety can deter tourists, leading to a decline in revenue for businesses reliant on the tourism industry. The economic repercussions extend beyond tourism-related sectors to impact the broader local economy.

Rebuilding and Stimulating Economic Recovery

While natural disasters bring immense challenges, they also present opportunities for economic revitalization. The rebuilding phase necessitates investments in construction, infrastructure, and technology. Governments, businesses, and communities can work together to stimulate

Balancing Act: Navigating US Fiscal Policy Challenges

Balancing Act: Navigating US Fiscal Policy Challenges

As the United States continues to navigate complex economic landscapes, its fiscal policy plays a pivotal role in shaping the nation’s financial trajectory. This article delves into the intricate web of challenges and considerations involved in managing US fiscal policy and the implications for economic stability and growth.

Foundation of Economic Management

US fiscal policy, often overseen by government agencies and policymakers, forms the foundation of economic management. It involves decisions related to taxation, government spending, and borrowing, collectively influencing the overall economic health of the nation. Striking the right balance in these areas is crucial for maintaining stability and fostering sustainable economic growth.

The Dual Role of Fiscal Policy

Fiscal policy serves a dual role in economic management. During periods of economic downturn, the government may implement expansionary fiscal policies, such as tax cuts and increased spending, to stimulate economic activity. Conversely, during times of overheating and inflationary pressures, contractionary fiscal policies may be employed to cool down the economy. This delicate dance requires precision to avoid unintended consequences.

Taxation Strategies and Economic Impact

One of the key components of US fiscal policy is taxation. Decisions related to tax rates, deductions, and credits have direct implications for businesses and individuals. Striking a balance between providing necessary government revenue and avoiding stifling economic activity is a constant challenge. Effective tax policies aim to encourage investment, job creation, and overall economic prosperity.

Government Spending Priorities

Determining government spending priorities is a critical aspect of fiscal policy. Allocation of funds to areas such as infrastructure, education, healthcare, and defense reflects national priorities. Striking a balance between addressing immediate needs and making long-term investments is essential. Efficient and targeted government spending can spur economic growth, create jobs, and enhance the overall well-being of the population.

Debt Management and Fiscal Responsibility

Managing the national debt is a perpetual challenge within the realm of fiscal policy. While borrowing can be a tool for financing essential initiatives, an unsustainable debt burden can lead to economic instability. Striking a balance between leveraging debt for strategic investments and ensuring fiscal responsibility is essential to avoid long-term economic consequences.

Global Economic Considerations

The interconnectedness of the global economy adds another layer of complexity to US fiscal policy. Economic decisions made in the United States have ripple effects worldwide. Coordinating fiscal policies with international economic conditions is crucial for maintaining stability and fostering collaborative solutions to global challenges.

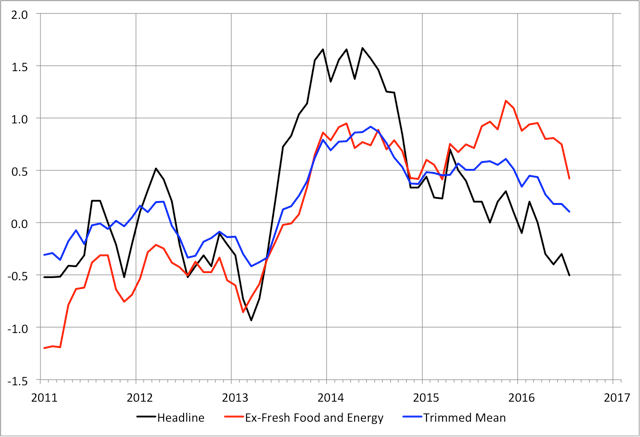

Inflationary Pressures and Monetary Policy Coordination

Balancing fiscal policy with monetary policy is vital for economic stability. Inflationary pressures, influenced by fiscal decisions, require coordination with the Federal Reserve’s monetary policies. Effective collaboration ensures a harmonized approach to managing interest rates, money supply, and overall economic conditions.

Challenges in Times of Crisis

During times of crisis, such as a recession or a global pandemic, the challenges facing US fiscal policy become more pronounced. Rapid response mechanisms, such as stimulus packages and targeted interventions, must be deployed to mitigate economic downturns. Striking the right balance between