Fiscal policy

Corporate Tax Reforms: Navigating Financial Landscapes

Introduction:

Corporate tax reforms play a pivotal role in shaping the financial landscapes for businesses. This article delves into the nuances of corporate tax reforms, exploring their impact on businesses, the broader economy, and how organizations navigate these changes.

Understanding Corporate Tax Reforms:

Corporate tax reforms encompass changes in the tax policies that directly affect businesses. These reforms can include alterations to tax rates, deductions, credits, and overall structures aimed at influencing corporate behavior, economic growth, and government revenue.

Corporate Tax Reforms Link:

For a comprehensive understanding of Corporate Tax Reforms and their implications, visit here. Stay informed about the latest developments in tax policies and their impact on businesses.

Impact on Business Finances:

One of the primary impacts of corporate tax reforms is on the financial health of businesses. Changes in tax rates directly influence the amount of income businesses retain, affecting profitability, investment decisions, and overall financial planning.

Incentivizing Investment and Innovation:

Governments often design tax reforms to incentivize specific behaviors, such as increased investment and innovation. By offering tax credits or deductions for research and development activities, governments aim to stimulate economic growth and foster a competitive business environment.

Navigating Tax Compliance Challenges:

With corporate tax reforms come changes in tax compliance requirements. Businesses must navigate evolving tax codes, ensuring accurate reporting and adherence to new regulations. This can pose challenges, especially for multinational corporations operating in multiple jurisdictions with varying tax laws.

International Tax Considerations:

Corporate tax reforms frequently have implications for international businesses. Changes in global tax frameworks, such as Base Erosion and Profit Shifting (BEPS) initiatives, impact how multinational corporations structure their operations to align with evolving international tax standards.

Small Business Implications:

While large corporations often dominate discussions on corporate tax, small businesses also feel the impact of reforms. Changes in tax rates and regulations can significantly influence the operating costs, growth strategies, and overall viability of small enterprises.

Government Revenue and Fiscal Policy:

Corporate tax reforms are integral components of government fiscal policies. Adjustments in tax rates directly impact government revenue, influencing budget allocations, public spending, and the ability to fund essential services and infrastructure projects.

Public Perception and Corporate Social Responsibility:

Corporate tax practices are increasingly under public scrutiny. Reforms aimed at addressing perceived tax avoidance or ensuring corporations pay their fair share align with growing expectations for corporate social responsibility. Businesses need to consider public perception in their tax strategies.

Strategic Tax Planning for Businesses:

In the face of corporate tax reforms, businesses must engage in strategic tax planning. This involves assessing the impact of reforms on their financial positions, exploring available incentives, and aligning tax strategies with broader business goals to optimize their overall tax positions.

Conclusion:

Corporate tax reforms are dynamic forces that shape the financial landscape for businesses of all sizes. Navigating these changes requires a strategic and informed approach. By understanding the implications of reforms, staying abreast of regulatory developments, and engaging in proactive tax planning, businesses can adapt to the evolving tax environment and

Shaping Prosperity: Government Economic Policies

Crafting Economic Futures: Understanding Government Economic Policies

Governments play a pivotal role in shaping the economic landscape through a variety of policies. This article delves into the complexities and impacts of government economic policies, exploring the key areas where policy decisions influence the prosperity and well-being of nations.

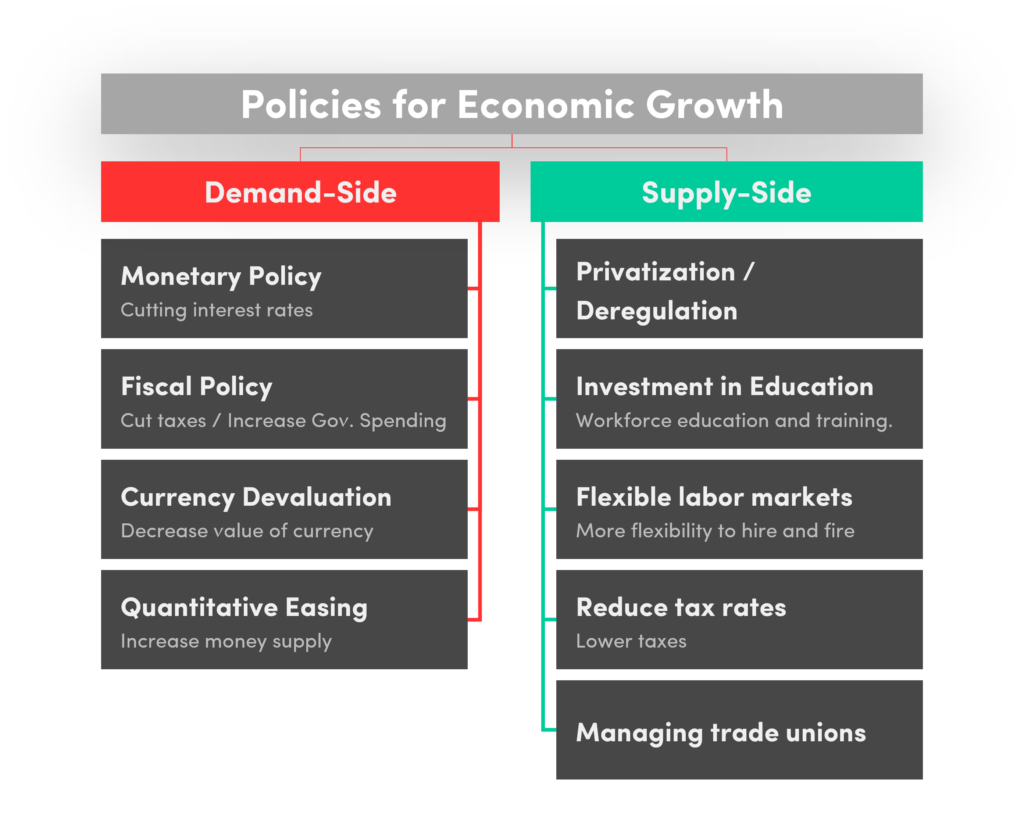

Monetary Policy: The Central Bank’s Toolbox

One of the primary tools in a government’s economic policy arsenal is monetary policy, typically executed by the central bank. Through actions like setting interest rates and influencing money supply, monetary policy aims to regulate inflation, employment, and overall economic stability. Understanding the intricacies of monetary policy provides insights into a nation’s economic direction.

Fiscal Policy: Government Spending and Taxation

Fiscal policy involves the government’s use of spending and taxation to influence the economy. During economic downturns, governments may increase spending or cut taxes to stimulate growth, while during periods of expansion, they may reduce spending or raise taxes to prevent overheating. Analyzing fiscal policy decisions unveils the government’s economic priorities.

Trade Policies: Navigating Global Economic Relationships

In an interconnected world, trade policies play a crucial role in shaping a nation’s economic relationships. Governments implement trade agreements, tariffs, and trade restrictions to protect domestic industries, foster international trade, and maintain a competitive edge. Understanding the nuances of trade policies is vital for businesses and investors navigating the global market.

Labor Market Regulations: Balancing Worker Protections and Flexibility

Government policies regarding the labor market can significantly impact employment dynamics. Regulations on minimum wage, working hours, and employee rights aim to protect workers, but they can also influence hiring practices and business operations. Examining the balance between worker protections and business flexibility sheds light on the overall economic environment.

Taxation Policies: Influencing Economic Behavior

Tax policies are powerful instruments for governments to influence economic behavior. From corporate taxes to individual income taxes, policy decisions can impact investment, spending, and saving patterns. Understanding the goals and implications of taxation policies is crucial for businesses and individuals navigating the fiscal landscape.

Environmental Policies: Sustainable Development Initiatives

As environmental concerns gain prominence, governments are increasingly implementing policies to promote sustainable development. From emissions regulations to renewable energy incentives, environmental policies influence industries’ practices and consumer choices. Analyzing these policies provides insights into a government’s commitment to environmental stewardship.

Innovation and Technology Policies: Fostering Growth and Competitiveness

Governments often invest in policies aimed at fostering innovation and technological advancements. Research and development incentives, patent protections, and support for emerging industries contribute to a nation’s competitiveness in the global market. Exploring innovation policies unveils a government’s strategy for long-term economic growth.

Social Welfare Policies: Addressing Inequality and Well-being

Social welfare policies, including healthcare, education, and social safety nets, play a vital role in promoting societal well-being and addressing inequality. Government decisions in these areas impact access to essential services and contribute to the overall quality of life for citizens. Understanding social welfare policies is integral to assessing a government’s commitment to societal welfare.

Visit Government Economic Policies for In-Depth Insights

For a comprehensive