Taxation policies

Government Policies: Business Impact and Strategic Responses

Introduction:

Government policies play a pivotal role in shaping the business environment, influencing operations, and driving strategic decisions. In this article, we delve into the multifaceted impact of government policies on businesses and how organizations strategically respond to these dynamics.

Navigating Regulatory Frameworks:

One of the primary ways government policies impact businesses is through regulatory frameworks. From industry-specific regulations to broader compliance standards, organizations must navigate a complex landscape to ensure adherence and avoid legal repercussions. The ability to interpret and comply with regulations is crucial for maintaining business continuity.

Government Policies Link:

Explore the intricate relationship between government policies and businesses here. Gain insights into how businesses navigate regulatory challenges and adapt to changing policy landscapes.

Taxation Policies and Fiscal Measures:

Taxation policies significantly influence business operations and financial strategies. Changes in tax laws, incentives, or fiscal measures can impact profitability and investment decisions. Businesses often need to reassess their financial structures and adopt tax-efficient strategies to optimize their financial performance within the given policy framework.

Trade and Tariff Dynamics:

Global businesses are particularly sensitive to trade and tariff policies. Government decisions on tariffs, trade agreements, and international relations directly influence supply chains, production costs, and market access. Organizations must stay agile to adapt to shifting trade dynamics and explore alternative strategies to mitigate potential disruptions.

Labor Laws and Workplace Policies:

Government policies related to labor and workplace practices impact how businesses manage their workforce. Regulations on employment contracts, working hours, and safety standards influence HR policies and organizational structures. Adapting to these policies is vital for fostering a positive work environment and ensuring compliance.

Environmental and Sustainability Regulations:

In an era of increasing environmental awareness, governments are implementing regulations to promote sustainability and environmental responsibility. Businesses must align with these policies, adopting eco-friendly practices, reducing carbon footprints, and integrating sustainability into their corporate strategies to meet both regulatory requirements and consumer expectations.

Consumer Protection and Privacy Laws:

Government policies related to consumer protection and data privacy have become more stringent. Businesses handling consumer data must comply with privacy laws to safeguard sensitive information. Navigating this regulatory landscape requires robust data protection measures and transparent communication with consumers about data usage.

Government Subsidies and Incentives:

Governments often provide subsidies and incentives to support specific industries or activities. Businesses can strategically leverage these offerings to reduce costs, spur innovation, and gain a competitive edge. Understanding and capitalizing on available subsidies is a key aspect of strategic business planning.

Health and Safety Regulations:

The global health crisis has emphasized the critical role of health and safety regulations. Governments are implementing measures to safeguard public health, impacting how businesses operate. Adhering to these regulations is not only a legal requirement but also essential for maintaining the well-being of employees and customers.

Strategic Responses to Government Policies:

Businesses must proactively respond to government policies to thrive in a dynamic regulatory environment. This involves conducting thorough policy analysis, engaging in advocacy when necessary, and developing strategic plans that align with regulatory expectations. By

Shaping Prosperity: Government Economic Policies

Crafting Economic Futures: Understanding Government Economic Policies

Governments play a pivotal role in shaping the economic landscape through a variety of policies. This article delves into the complexities and impacts of government economic policies, exploring the key areas where policy decisions influence the prosperity and well-being of nations.

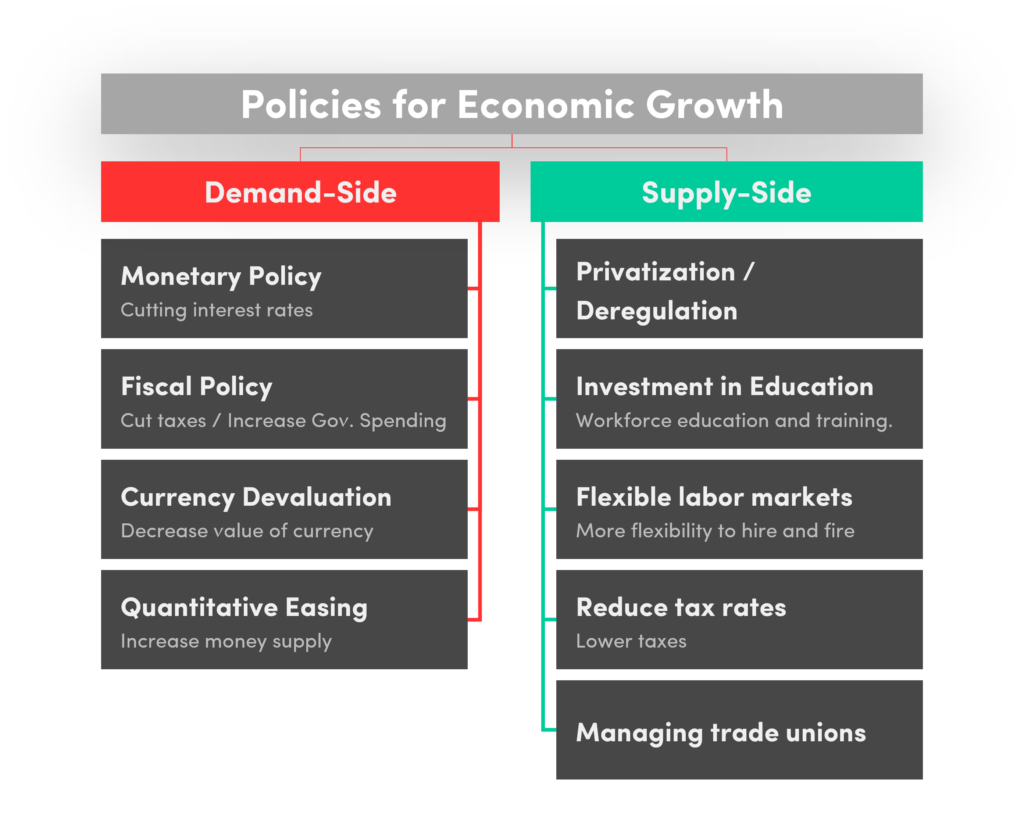

Monetary Policy: The Central Bank’s Toolbox

One of the primary tools in a government’s economic policy arsenal is monetary policy, typically executed by the central bank. Through actions like setting interest rates and influencing money supply, monetary policy aims to regulate inflation, employment, and overall economic stability. Understanding the intricacies of monetary policy provides insights into a nation’s economic direction.

Fiscal Policy: Government Spending and Taxation

Fiscal policy involves the government’s use of spending and taxation to influence the economy. During economic downturns, governments may increase spending or cut taxes to stimulate growth, while during periods of expansion, they may reduce spending or raise taxes to prevent overheating. Analyzing fiscal policy decisions unveils the government’s economic priorities.

Trade Policies: Navigating Global Economic Relationships

In an interconnected world, trade policies play a crucial role in shaping a nation’s economic relationships. Governments implement trade agreements, tariffs, and trade restrictions to protect domestic industries, foster international trade, and maintain a competitive edge. Understanding the nuances of trade policies is vital for businesses and investors navigating the global market.

Labor Market Regulations: Balancing Worker Protections and Flexibility

Government policies regarding the labor market can significantly impact employment dynamics. Regulations on minimum wage, working hours, and employee rights aim to protect workers, but they can also influence hiring practices and business operations. Examining the balance between worker protections and business flexibility sheds light on the overall economic environment.

Taxation Policies: Influencing Economic Behavior

Tax policies are powerful instruments for governments to influence economic behavior. From corporate taxes to individual income taxes, policy decisions can impact investment, spending, and saving patterns. Understanding the goals and implications of taxation policies is crucial for businesses and individuals navigating the fiscal landscape.

Environmental Policies: Sustainable Development Initiatives

As environmental concerns gain prominence, governments are increasingly implementing policies to promote sustainable development. From emissions regulations to renewable energy incentives, environmental policies influence industries’ practices and consumer choices. Analyzing these policies provides insights into a government’s commitment to environmental stewardship.

Innovation and Technology Policies: Fostering Growth and Competitiveness

Governments often invest in policies aimed at fostering innovation and technological advancements. Research and development incentives, patent protections, and support for emerging industries contribute to a nation’s competitiveness in the global market. Exploring innovation policies unveils a government’s strategy for long-term economic growth.

Social Welfare Policies: Addressing Inequality and Well-being

Social welfare policies, including healthcare, education, and social safety nets, play a vital role in promoting societal well-being and addressing inequality. Government decisions in these areas impact access to essential services and contribute to the overall quality of life for citizens. Understanding social welfare policies is integral to assessing a government’s commitment to societal welfare.

Visit Government Economic Policies for In-Depth Insights

For a comprehensive