Government economic policies

Shaping Prosperity: Government Economic Policies

Crafting Economic Futures: Understanding Government Economic Policies

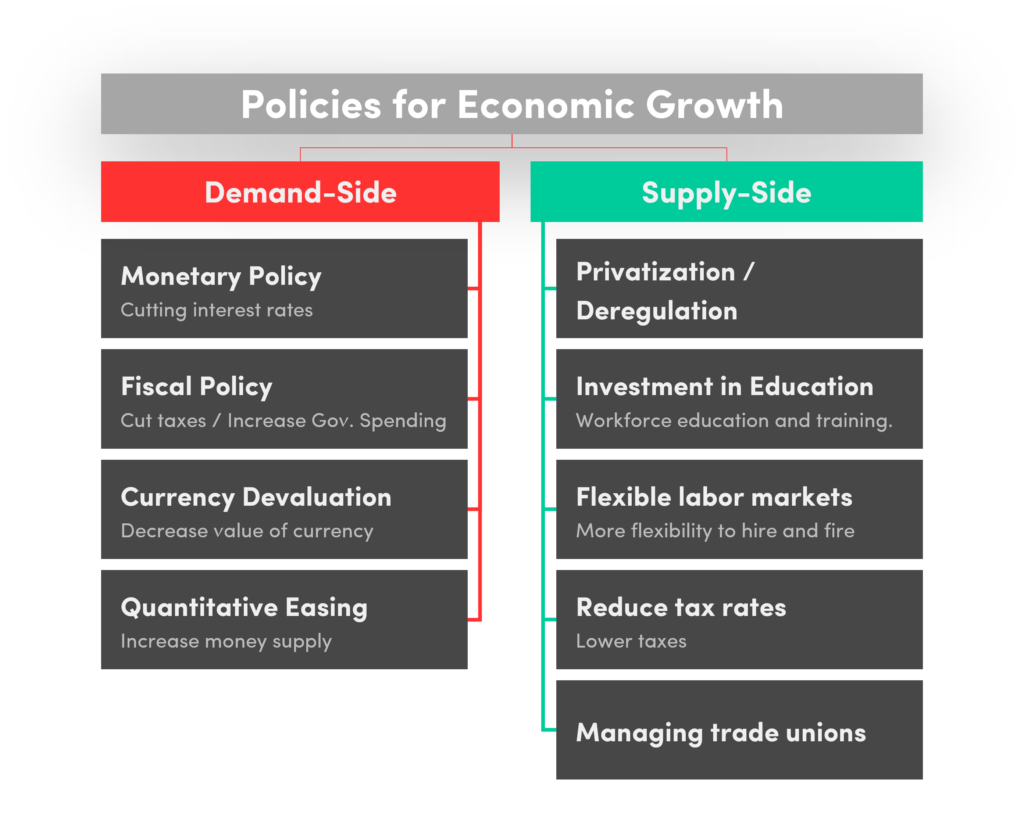

Governments play a pivotal role in shaping the economic landscape through a variety of policies. This article delves into the complexities and impacts of government economic policies, exploring the key areas where policy decisions influence the prosperity and well-being of nations.

Monetary Policy: The Central Bank’s Toolbox

One of the primary tools in a government’s economic policy arsenal is monetary policy, typically executed by the central bank. Through actions like setting interest rates and influencing money supply, monetary policy aims to regulate inflation, employment, and overall economic stability. Understanding the intricacies of monetary policy provides insights into a nation’s economic direction.

Fiscal Policy: Government Spending and Taxation

Fiscal policy involves the government’s use of spending and taxation to influence the economy. During economic downturns, governments may increase spending or cut taxes to stimulate growth, while during periods of expansion, they may reduce spending or raise taxes to prevent overheating. Analyzing fiscal policy decisions unveils the government’s economic priorities.

Trade Policies: Navigating Global Economic Relationships

In an interconnected world, trade policies play a crucial role in shaping a nation’s economic relationships. Governments implement trade agreements, tariffs, and trade restrictions to protect domestic industries, foster international trade, and maintain a competitive edge. Understanding the nuances of trade policies is vital for businesses and investors navigating the global market.

Labor Market Regulations: Balancing Worker Protections and Flexibility

Government policies regarding the labor market can significantly impact employment dynamics. Regulations on minimum wage, working hours, and employee rights aim to protect workers, but they can also influence hiring practices and business operations. Examining the balance between worker protections and business flexibility sheds light on the overall economic environment.

Taxation Policies: Influencing Economic Behavior

Tax policies are powerful instruments for governments to influence economic behavior. From corporate taxes to individual income taxes, policy decisions can impact investment, spending, and saving patterns. Understanding the goals and implications of taxation policies is crucial for businesses and individuals navigating the fiscal landscape.

Environmental Policies: Sustainable Development Initiatives

As environmental concerns gain prominence, governments are increasingly implementing policies to promote sustainable development. From emissions regulations to renewable energy incentives, environmental policies influence industries’ practices and consumer choices. Analyzing these policies provides insights into a government’s commitment to environmental stewardship.

Innovation and Technology Policies: Fostering Growth and Competitiveness

Governments often invest in policies aimed at fostering innovation and technological advancements. Research and development incentives, patent protections, and support for emerging industries contribute to a nation’s competitiveness in the global market. Exploring innovation policies unveils a government’s strategy for long-term economic growth.

Social Welfare Policies: Addressing Inequality and Well-being

Social welfare policies, including healthcare, education, and social safety nets, play a vital role in promoting societal well-being and addressing inequality. Government decisions in these areas impact access to essential services and contribute to the overall quality of life for citizens. Understanding social welfare policies is integral to assessing a government’s commitment to societal welfare.

Visit Government Economic Policies for In-Depth Insights

For a comprehensive