Global influences

Navigating Unemployment Rate Trends: Insights for Today’s Economy

Deciphering Unemployment Rate Trends: A Comprehensive Analysis

Understanding the nuances of unemployment rate trends is crucial in navigating the complex terrain of today’s economy. This article delves into the intricacies of this economic indicator, shedding light on its impact and providing insights for individuals and policymakers alike.

The Unemployment Rate Unveiled: Defining the Metric

The unemployment rate is a key economic indicator that reflects the percentage of the labor force without employment. This metric serves as a thermometer for the job market, providing a snapshot of economic health. Examining its trends allows for a deeper understanding of the dynamics shaping the workforce landscape.

Historical Perspectives: Tracing the Evolution of Unemployment

To comprehend the present, it is essential to glance back at the historical context of unemployment rate trends. Examining patterns over time reveals the resilience of economies in overcoming challenges and adapting to changing circumstances. Historical perspectives offer valuable insights for shaping effective policies and responses.

Economic Downturns and Surges: Unraveling Cause and Effect

Unemployment rate trends often mirror economic downturns and surges. During times of recession, the rate tends to rise as businesses cut costs and reduce their workforce. Conversely, economic upturns see a decline in unemployment as businesses expand, creating more job opportunities. Understanding this cause-and-effect relationship is crucial for anticipating economic shifts.

Impact on Communities: Beyond Numbers to Real Lives

Behind every unemployment rate is a human story. The impact of job loss extends beyond statistical figures, affecting individuals, families, and entire communities. Exploring the human aspect of unemployment emphasizes the importance of proactive measures to mitigate its effects, such as job training programs and social support systems.

Government Policies and Interventions: Balancing Act for Stability

Policymakers play a pivotal role in influencing unemployment rate trends through economic interventions. Government policies, such as fiscal stimulus packages and job creation initiatives, aim to stabilize the job market during challenging times. Analyzing the effectiveness of these interventions is crucial for shaping future economic strategies.

Global Influences: Unemployment in a Connected World

In an era of globalization, unemployment rate trends are not isolated within national borders. Global economic factors, trade relationships, and geopolitical events can have a significant impact on local job markets. Understanding these interconnected influences provides a more comprehensive view for policymakers and businesses alike.

Technological Advancements: Shaping the Future of Employment

The rise of technology introduces a dynamic element to unemployment rate trends. Automation, artificial intelligence, and evolving job requirements contribute to a shifting employment landscape. Adapting to these changes requires forward-thinking strategies to ensure the workforce remains equipped with the skills demanded by emerging industries.

Education and Skill Development: Building Resilience

In the face of evolving employment trends, education and skill development become paramount. Empowering individuals with the right skills not only enhances their employability but also contributes to overall economic resilience. Investments in education and training programs play a crucial role in aligning the workforce with the demands of a rapidly changing job market.

Charting the Course Forward: Utilizing Insights for Progress

As we navigate

Navigating USA’s Inflation Landscape: Trends and Implications

Decoding the Complexities of Inflation Rate in the USA

Understanding the nuances of inflation rate trends is essential for individuals, businesses, and policymakers navigating the economic landscape. This article delves into the intricacies of inflation in the USA, shedding light on its trends and implications.

Defining Inflation: The Economic Phenomenon

Inflation refers to the sustained increase in the general price level of goods and services over time. While moderate inflation is a normal part of a healthy economy, excessive inflation or deflation can have far-reaching consequences. Monitoring inflation rates is crucial for maintaining economic stability.

Factors Influencing Inflation: Unraveling the Web

Several factors contribute to inflationary pressures. Demand-pull inflation occurs when demand for goods and services surpasses their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs, such as increased wages or commodity prices. Understanding these dynamics helps in predicting inflationary trends.

The Role of Monetary Policy: Managing Inflation

Central banks, including the Federal Reserve in the USA, play a pivotal role in managing inflation. Through monetary policy tools like interest rates and open market operations, central banks aim to control inflation and stabilize the economy. Observing the actions of central banks provides insights into their stance on inflation management.

Consumer Price Index (CPI): A Key Metric

The Consumer Price Index (CPI) is a widely used indicator for tracking inflation. It measures the average change in prices paid by consumers for a basket of goods and services. An increasing CPI indicates rising inflation. Analyzing CPI trends allows individuals and businesses to gauge the impact on their purchasing power.

Inflation and Investments: Navigating the Impact

Inflation has significant implications for investments. While moderate inflation erodes the real value of money, hyperinflation can devastate savings. Investors often seek assets that provide a hedge against inflation, such as real estate, commodities, or Treasury Inflation-Protected Securities (TIPS). Strategically diversifying portfolios is key to mitigating the impact of inflation on investments.

Wage Growth and Inflation: Balancing Act

Wage growth is a crucial element in the inflation puzzle. When wages rise at a pace similar to or higher than inflation, consumers maintain their purchasing power. However, if wages lag behind inflation, individuals experience a decline in real income. Examining the relationship between wage growth and inflation offers insights into economic health.

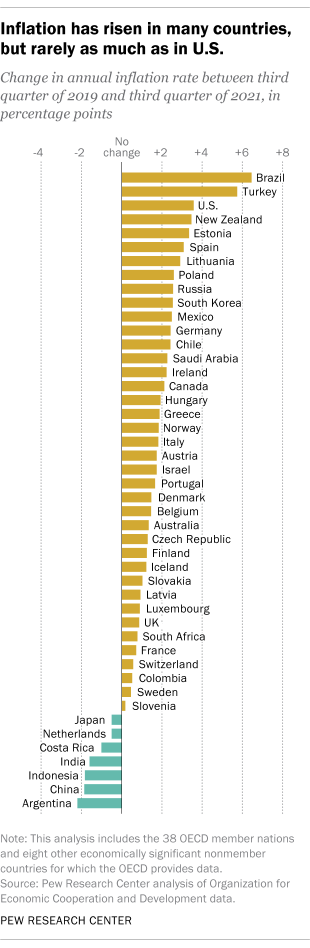

Global Influences on Inflation: A Connected World

In an era of globalization, the USA’s inflation rate is influenced by global economic dynamics. Fluctuations in commodity prices, international trade relationships, and geopolitical events can impact inflation. Understanding these global influences provides a more comprehensive view for policymakers and businesses alike.

Inflation Expectations: Shaping Economic Behavior

Expectations of future inflation can influence present economic behavior. If individuals and businesses anticipate rising prices, they may adjust spending and investment patterns. Central banks closely monitor inflation expectations as they strive to anchor them at levels consistent with their inflation targets.

Strategies for Inflationary Environments: A Pragmatic Approach

Inflationary environments require individuals and businesses to adopt pragmatic strategies. These may include negotiating fixed-price

Navigating Financial Waters: Interest Rates in the USA

Decoding Economic Signposts: Interest Rates in the USA

Understanding interest rates in the USA is pivotal for both financial markets and everyday consumers. This article explores the multifaceted aspects of interest rates, their role in the economy, and the impact they have on various sectors.

Fundamentals of Interest Rates: The Building Blocks

Interest rates represent the cost of borrowing money or the return on investment. Controlled by central banks, they serve as a lever for economic management. Analyzing the fundamental principles of interest rates provides a foundation for grasping their broader implications.

Central Bank Dynamics: The Federal Reserve’s Role

The Federal Reserve, the USA’s central bank, plays a central role in setting and influencing interest rates. Through mechanisms like the federal funds rate, the Fed regulates borrowing costs and shapes monetary policy. Understanding the dynamics of the Federal Reserve is crucial for interpreting interest rate movements.

Economic Indicators: Interest Rates as Barometers

Interest rates act as barometers for economic health. The Federal Reserve adjusts rates based on economic indicators such as inflation, employment, and GDP growth. Examining how interest rates respond to these indicators provides insights into the overall economic climate.

Consumer Impact: Borrowing Costs and Spending Habits

For consumers, interest rates directly influence borrowing costs. Whether obtaining a mortgage, car loan, or using credit cards, changes in interest rates impact spending and saving habits. Monitoring interest rate trends allows individuals to make informed financial decisions.

Business Investments: Capitalizing on Rate Environments

Interest rates influence corporate decisions on investments and expansions. Lower rates may encourage businesses to borrow for growth, while higher rates may lead to more conservative financial strategies. Analyzing the relationship between interest rates and business investments provides a glimpse into economic vitality.

Real Estate Dynamics: Mortgages and Property Markets

The real estate sector is particularly sensitive to interest rate fluctuations. Mortgage rates, influenced by broader interest rate trends, impact homebuyers’ affordability. Understanding how interest rates affect real estate dynamics is crucial for homeowners, buyers, and industry professionals.

Stock Market Reactions: Investors’ Sentiment and Strategies

Interest rates play a significant role in shaping investors’ sentiment in the stock market. As rates change, stock prices may respond accordingly. Investors often adjust their portfolios based on interest rate expectations, making the analysis of this relationship integral for investment decisions.

Inflationary Pressures: Balancing Act for Monetary Policy

Interest rates also serve as a tool to control inflation. By adjusting rates, central banks aim to strike a balance between stimulating economic growth and preventing excessive inflation. Examining how interest rates contribute to this delicate balancing act provides insights into monetary policy.

Global Influences: Interest Rates in a Connected World

Interest rates in the USA have implications beyond its borders. Global economic interconnectedness means that rate changes can affect international trade, currency values, and financial markets worldwide. Understanding the global influences on interest rates is crucial for businesses and policymakers.

Visit Interest Rates in the USA for In-Depth Insights

For a comprehensive exploration of interest rates in the USA, visit Interest Rates in