Economic trends

Evolving Landscape: Trends in Wage Growth

Deciphering the Dynamics: Exploring Wage Growth Trends

Wage growth trends are integral to understanding the economic landscape and the well-being of the workforce. This article delves into the multifaceted aspects of wage growth, exploring its trends, implications, and the factors that shape this critical component of economic health.

Historical Perspectives: Tracing the Trajectory of Wage Growth

To comprehend wage growth trends, it’s essential to examine historical perspectives. Analyzing wage growth over time provides insights into patterns, cyclical variations, and the impact of economic events. Historical context illuminates the trajectory and helps anticipate future trends.

Macro vs. Micro Factors: Influences on Wage Growth

Wage growth is influenced by a combination of macro and micro factors. Macro-economic conditions such as inflation, overall economic growth, and labor market dynamics play a role. Simultaneously, micro factors like industry-specific trends, company policies, and skill demand contribute to the nuanced landscape of wage growth.

Skills and Education: Bridging the Wage Gap

The correlation between skills, education, and wage growth is profound. In an era where skill requirements evolve rapidly, individuals with in-demand skills often experience higher wage growth. Investing in education and skills development becomes crucial for both individuals and the overall economic landscape.

Inequality Concerns: Addressing Disparities in Wage Growth

As wage growth trends unfold, concerns about income inequality often come to the forefront. Examining disparities in wage growth among different demographic groups and addressing systemic issues becomes imperative for fostering a fair and inclusive economic environment.

Government Policies: Impact on Wage Growth Dynamics

Government policies wield significant influence over wage growth trends. Minimum wage laws, tax policies, and social welfare programs directly impact the income distribution. Evaluating the effects of government interventions provides insights into the role of policy in shaping wage growth.

Globalization Effects: Navigating a Connected World

In a globalized economy, wage growth is not solely influenced by domestic factors. International trade, outsourcing, and global economic shifts play a role. Understanding how globalization affects wage growth trends is essential for governments and businesses navigating the interconnected global marketplace.

Technological Advances: Automation and Wage Growth Challenges

The rise of automation and technological advancements introduces new dimensions to wage growth trends. While technology can enhance productivity, it may also lead to job displacement. Striking a balance between technological progress and ensuring fair wage growth becomes a complex challenge for policymakers.

Unionization Impact: Collective Bargaining in Wage Growth

The role of labor unions in negotiating wages and working conditions is pivotal. Examining how unionization impacts wage growth provides insights into the collective bargaining power of workers. The dynamics of labor-management relations contribute to the overall landscape of wage growth.

Economic Outlook: Forecasting Future Wage Growth Trends

As we navigate the complexities of wage growth, forecasting future trends becomes a strategic imperative. Economic projections, industry analyses, and labor market assessments contribute to understanding the anticipated trajectory of wage growth. This foresight is valuable for individuals, businesses, and policymakers alike.

Visit Wage Growth Trends for In-Depth Insights

For those seeking comprehensive insights into wage growth trends, visit

Navigating USA’s Inflation Landscape: Trends and Implications

Decoding the Complexities of Inflation Rate in the USA

Understanding the nuances of inflation rate trends is essential for individuals, businesses, and policymakers navigating the economic landscape. This article delves into the intricacies of inflation in the USA, shedding light on its trends and implications.

Defining Inflation: The Economic Phenomenon

Inflation refers to the sustained increase in the general price level of goods and services over time. While moderate inflation is a normal part of a healthy economy, excessive inflation or deflation can have far-reaching consequences. Monitoring inflation rates is crucial for maintaining economic stability.

Factors Influencing Inflation: Unraveling the Web

Several factors contribute to inflationary pressures. Demand-pull inflation occurs when demand for goods and services surpasses their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs, such as increased wages or commodity prices. Understanding these dynamics helps in predicting inflationary trends.

The Role of Monetary Policy: Managing Inflation

Central banks, including the Federal Reserve in the USA, play a pivotal role in managing inflation. Through monetary policy tools like interest rates and open market operations, central banks aim to control inflation and stabilize the economy. Observing the actions of central banks provides insights into their stance on inflation management.

Consumer Price Index (CPI): A Key Metric

The Consumer Price Index (CPI) is a widely used indicator for tracking inflation. It measures the average change in prices paid by consumers for a basket of goods and services. An increasing CPI indicates rising inflation. Analyzing CPI trends allows individuals and businesses to gauge the impact on their purchasing power.

Inflation and Investments: Navigating the Impact

Inflation has significant implications for investments. While moderate inflation erodes the real value of money, hyperinflation can devastate savings. Investors often seek assets that provide a hedge against inflation, such as real estate, commodities, or Treasury Inflation-Protected Securities (TIPS). Strategically diversifying portfolios is key to mitigating the impact of inflation on investments.

Wage Growth and Inflation: Balancing Act

Wage growth is a crucial element in the inflation puzzle. When wages rise at a pace similar to or higher than inflation, consumers maintain their purchasing power. However, if wages lag behind inflation, individuals experience a decline in real income. Examining the relationship between wage growth and inflation offers insights into economic health.

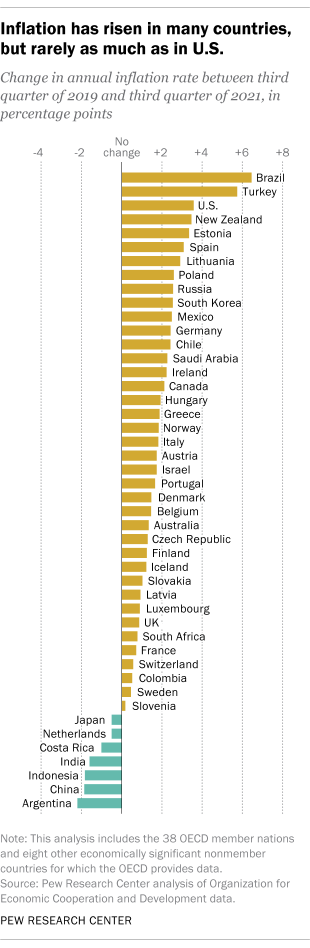

Global Influences on Inflation: A Connected World

In an era of globalization, the USA’s inflation rate is influenced by global economic dynamics. Fluctuations in commodity prices, international trade relationships, and geopolitical events can impact inflation. Understanding these global influences provides a more comprehensive view for policymakers and businesses alike.

Inflation Expectations: Shaping Economic Behavior

Expectations of future inflation can influence present economic behavior. If individuals and businesses anticipate rising prices, they may adjust spending and investment patterns. Central banks closely monitor inflation expectations as they strive to anchor them at levels consistent with their inflation targets.

Strategies for Inflationary Environments: A Pragmatic Approach

Inflationary environments require individuals and businesses to adopt pragmatic strategies. These may include negotiating fixed-price