Investment strategies

Navigating Stock Market Dynamics: Strategies for Optimal Performance

Unveiling the Intricacies of Stock Market Performance

Embarking on the journey of understanding stock market performance is akin to navigating a complex financial landscape. This article aims to unravel the intricacies, providing insights into strategies for optimal performance and informed decision-making.

The Dynamics of Stock Market Performance: A Primer

Stock market performance encapsulates the ebbs and flows of financial markets, reflecting the collective sentiment of investors. Understanding the dynamics involves delving into factors such as company earnings, economic indicators, and global events. This multifaceted approach is essential for grasping the nuances of stock market behavior.

Bull and Bear Markets: Riding the Waves

Stock markets are often characterized by bull and bear markets, representing periods of growth and decline, respectively. Recognizing the signs of these market cycles is crucial for investors. During bull markets, optimism prevails, and stocks generally rise. In contrast, bear markets witness pessimism, with stock prices falling. Strategic decision-making hinges on accurately identifying these market phases.

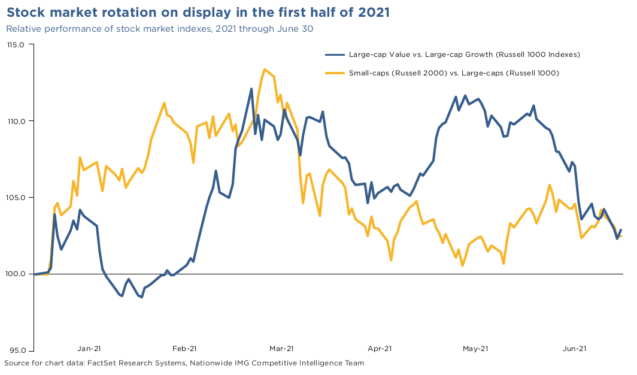

Market Indices: Gauging Overall Performance

Market indices, such as the S&P 500 and Dow Jones Industrial Average, serve as benchmarks for assessing stock market performance. They provide a snapshot of how a broad section of the market is faring. Monitoring these indices aids investors in making informed decisions, offering insights into overall market trends.

Volatility and Risk Management: Navigating Uncertainties

Volatility is an inherent aspect of stock market performance. Prices can experience significant fluctuations, creating both opportunities and risks. Successful investors employ risk management strategies to mitigate potential downsides. Diversification, setting stop-loss orders, and staying informed about market news are essential components of effective risk management.

Economic Indicators and Their Impact: Connecting the Dots

The interplay between stock market performance and economic indicators is profound. Factors like GDP growth, employment rates, and inflation influence investor confidence and, consequently, stock prices. A comprehensive understanding of these economic indicators enhances the ability to anticipate market movements.

Company Fundamentals: Digging Deeper for Long-Term Gains

Examining the fundamentals of individual companies is a cornerstone of successful stock market investing. Factors such as earnings per share, revenue growth, and debt levels offer insights into a company’s financial health. Long-term investors often focus on strong fundamentals, aiming for sustained growth over time.

Market Timing vs. Time in the Market: A Strategic Dilemma

A perennial dilemma for investors is whether to focus on market timing or time in the market. Market timing involves trying to predict the best moments to buy or sell stocks, while time in the market emphasizes the benefits of long-term investing. Striking a balance that aligns with individual risk tolerance and financial goals is paramount.

Behavioral Finance: Understanding Investor Psychology

Stock market performance is not solely dictated by economic factors; it is also deeply intertwined with investor psychology. Behavioral finance explores how emotions and cognitive biases influence financial decisions. Awareness of these psychological factors empowers investors to make rational choices and avoid succumbing to market hysteria.

Technological Advancements and Algorithmic Trading: Shaping the Future

The advent of technology has revolutionized stock market dynamics. Algorithmic trading,

Navigating USA’s Inflation Landscape: Trends and Implications

Decoding the Complexities of Inflation Rate in the USA

Understanding the nuances of inflation rate trends is essential for individuals, businesses, and policymakers navigating the economic landscape. This article delves into the intricacies of inflation in the USA, shedding light on its trends and implications.

Defining Inflation: The Economic Phenomenon

Inflation refers to the sustained increase in the general price level of goods and services over time. While moderate inflation is a normal part of a healthy economy, excessive inflation or deflation can have far-reaching consequences. Monitoring inflation rates is crucial for maintaining economic stability.

Factors Influencing Inflation: Unraveling the Web

Several factors contribute to inflationary pressures. Demand-pull inflation occurs when demand for goods and services surpasses their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs, such as increased wages or commodity prices. Understanding these dynamics helps in predicting inflationary trends.

The Role of Monetary Policy: Managing Inflation

Central banks, including the Federal Reserve in the USA, play a pivotal role in managing inflation. Through monetary policy tools like interest rates and open market operations, central banks aim to control inflation and stabilize the economy. Observing the actions of central banks provides insights into their stance on inflation management.

Consumer Price Index (CPI): A Key Metric

The Consumer Price Index (CPI) is a widely used indicator for tracking inflation. It measures the average change in prices paid by consumers for a basket of goods and services. An increasing CPI indicates rising inflation. Analyzing CPI trends allows individuals and businesses to gauge the impact on their purchasing power.

Inflation and Investments: Navigating the Impact

Inflation has significant implications for investments. While moderate inflation erodes the real value of money, hyperinflation can devastate savings. Investors often seek assets that provide a hedge against inflation, such as real estate, commodities, or Treasury Inflation-Protected Securities (TIPS). Strategically diversifying portfolios is key to mitigating the impact of inflation on investments.

Wage Growth and Inflation: Balancing Act

Wage growth is a crucial element in the inflation puzzle. When wages rise at a pace similar to or higher than inflation, consumers maintain their purchasing power. However, if wages lag behind inflation, individuals experience a decline in real income. Examining the relationship between wage growth and inflation offers insights into economic health.

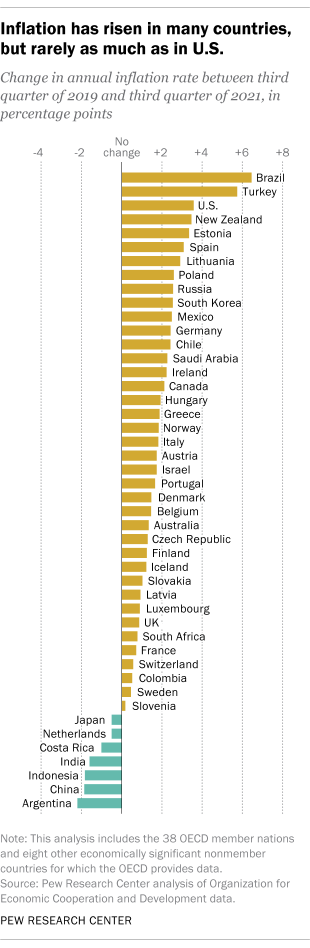

Global Influences on Inflation: A Connected World

In an era of globalization, the USA’s inflation rate is influenced by global economic dynamics. Fluctuations in commodity prices, international trade relationships, and geopolitical events can impact inflation. Understanding these global influences provides a more comprehensive view for policymakers and businesses alike.

Inflation Expectations: Shaping Economic Behavior

Expectations of future inflation can influence present economic behavior. If individuals and businesses anticipate rising prices, they may adjust spending and investment patterns. Central banks closely monitor inflation expectations as they strive to anchor them at levels consistent with their inflation targets.

Strategies for Inflationary Environments: A Pragmatic Approach

Inflationary environments require individuals and businesses to adopt pragmatic strategies. These may include negotiating fixed-price

Economic Resilience Amid Energy Law Transformations

Introduction:

The global energy landscape is undergoing profound transformations, marked by dynamic changes in energy laws. In this article, we explore the imperative of economic resilience in the face of evolving energy regulations and how businesses can navigate the challenges posed by these shifts.

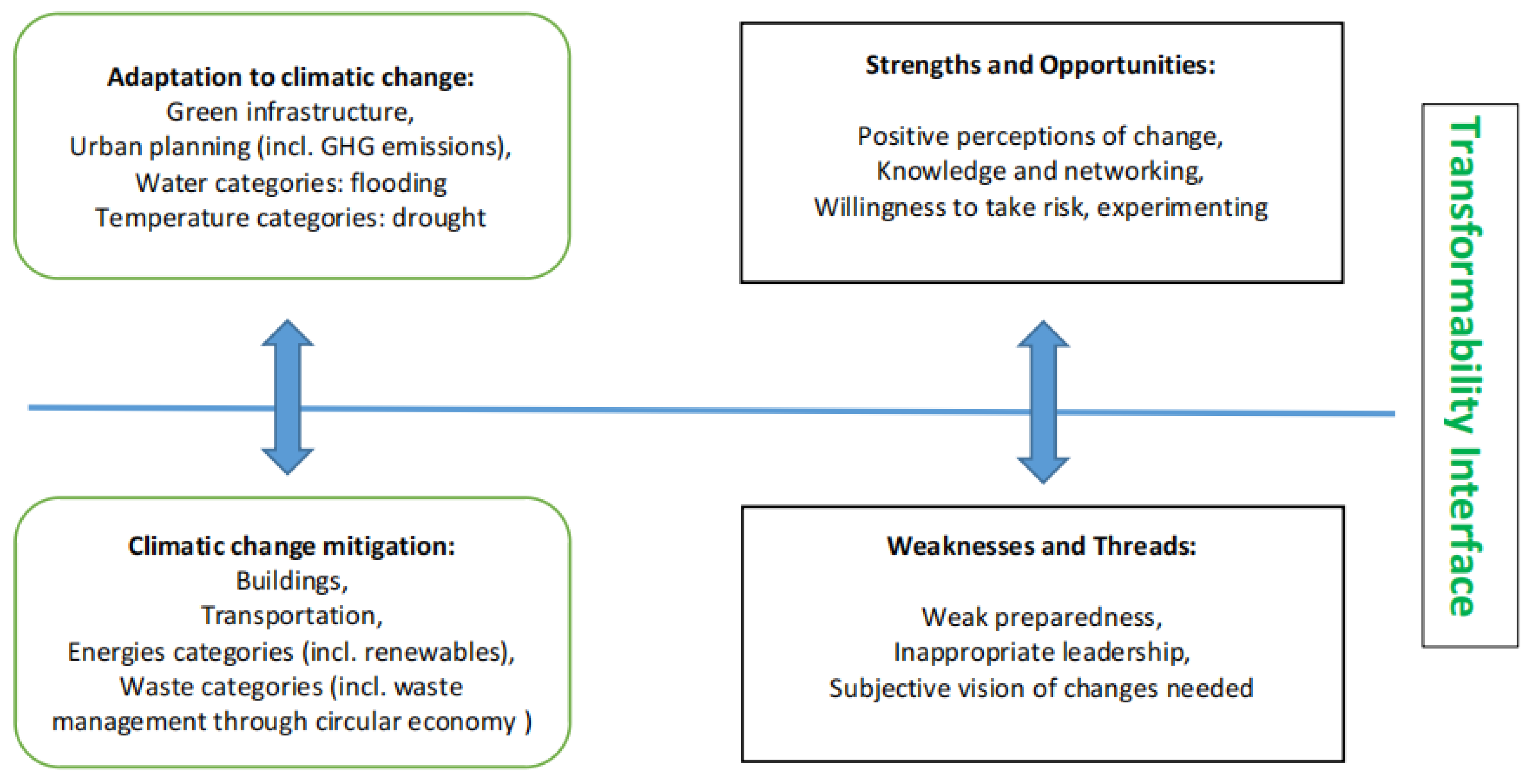

Adaptation in Energy Infrastructure:

One of the critical aspects of economic resilience amid changing energy laws is the adaptation of energy infrastructure. As regulations evolve to favor renewable sources and sustainability, businesses must invest in and adapt their energy infrastructure to align with the changing legal landscape. This adaptability ensures long-term resilience in the face of regulatory changes.

Investment Strategies and Energy Transition:

Economic resilience hinges on strategic investment decisions, particularly in the context of the energy transition. Companies that strategically invest in renewable energy sources and technologies can not only comply with changing energy laws but also position themselves as leaders in a sustainable and resilient future.

Impact on Energy Pricing and Affordability:

Changes in energy laws can have a direct impact on energy pricing and affordability. Economic resilience requires businesses to assess and manage the potential effects of regulatory changes on the cost of energy. Proactive measures, such as exploring energy-efficient technologies, can mitigate the impact on operational costs.

Diversification in Energy Sources:

To enhance economic resilience, businesses should consider diversifying their energy sources. Dependence on a single energy source may become a vulnerability as energy laws shift. A diversified energy portfolio, incorporating both traditional and renewable sources, provides a buffer against the uncertainties of changing regulations.

Energy Efficiency and Operational Costs:

Energy efficiency becomes a cornerstone of economic resilience. Changes in energy laws often incentivize energy-efficient practices. Companies that prioritize energy efficiency not only contribute to sustainability goals but also position themselves for cost savings, enhancing overall economic resilience.

Government Incentives and Economic Stimulus:

Governments often introduce incentives and economic stimulus packages to support businesses in adapting to changing energy laws. Understanding and leveraging these incentives can significantly contribute to economic resilience. Businesses should stay informed about available programs and strategically utilize them for sustainable growth.

Supply Chain Resilience and Energy Security:

Energy laws are intricately linked to supply chain resilience and energy security. Economic resilience requires businesses to assess the vulnerability of their supply chains to energy disruptions. Diversification of energy sources and strategic partnerships can enhance supply chain resilience in the face of evolving energy regulations.

Job Creation and Workforce Development:

The transition to new energy paradigms often creates opportunities for job creation and workforce development. Economic resilience involves aligning workforce skills with the emerging needs of the energy sector. Businesses can foster resilience by investing in training programs and ensuring a skilled workforce ready for the changing energy landscape.

Technological Innovation and Competitive Edge:

Economic resilience is closely tied to technological innovation. Companies that invest in innovative technologies aligned with changing energy laws can gain a competitive edge. Embracing innovation not only ensures compliance but also positions businesses as leaders in the evolving energy market.

Linking Economic Resilience to Strategic