Inflation expectations

Navigating USA’s Inflation Landscape: Trends and Implications

Decoding the Complexities of Inflation Rate in the USA

Understanding the nuances of inflation rate trends is essential for individuals, businesses, and policymakers navigating the economic landscape. This article delves into the intricacies of inflation in the USA, shedding light on its trends and implications.

Defining Inflation: The Economic Phenomenon

Inflation refers to the sustained increase in the general price level of goods and services over time. While moderate inflation is a normal part of a healthy economy, excessive inflation or deflation can have far-reaching consequences. Monitoring inflation rates is crucial for maintaining economic stability.

Factors Influencing Inflation: Unraveling the Web

Several factors contribute to inflationary pressures. Demand-pull inflation occurs when demand for goods and services surpasses their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs, such as increased wages or commodity prices. Understanding these dynamics helps in predicting inflationary trends.

The Role of Monetary Policy: Managing Inflation

Central banks, including the Federal Reserve in the USA, play a pivotal role in managing inflation. Through monetary policy tools like interest rates and open market operations, central banks aim to control inflation and stabilize the economy. Observing the actions of central banks provides insights into their stance on inflation management.

Consumer Price Index (CPI): A Key Metric

The Consumer Price Index (CPI) is a widely used indicator for tracking inflation. It measures the average change in prices paid by consumers for a basket of goods and services. An increasing CPI indicates rising inflation. Analyzing CPI trends allows individuals and businesses to gauge the impact on their purchasing power.

Inflation and Investments: Navigating the Impact

Inflation has significant implications for investments. While moderate inflation erodes the real value of money, hyperinflation can devastate savings. Investors often seek assets that provide a hedge against inflation, such as real estate, commodities, or Treasury Inflation-Protected Securities (TIPS). Strategically diversifying portfolios is key to mitigating the impact of inflation on investments.

Wage Growth and Inflation: Balancing Act

Wage growth is a crucial element in the inflation puzzle. When wages rise at a pace similar to or higher than inflation, consumers maintain their purchasing power. However, if wages lag behind inflation, individuals experience a decline in real income. Examining the relationship between wage growth and inflation offers insights into economic health.

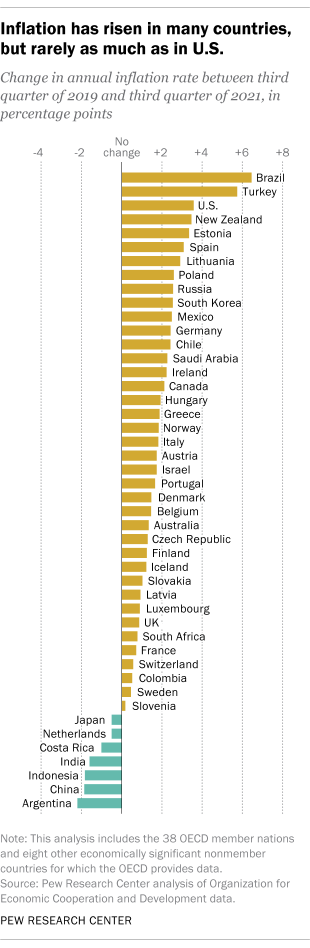

Global Influences on Inflation: A Connected World

In an era of globalization, the USA’s inflation rate is influenced by global economic dynamics. Fluctuations in commodity prices, international trade relationships, and geopolitical events can impact inflation. Understanding these global influences provides a more comprehensive view for policymakers and businesses alike.

Inflation Expectations: Shaping Economic Behavior

Expectations of future inflation can influence present economic behavior. If individuals and businesses anticipate rising prices, they may adjust spending and investment patterns. Central banks closely monitor inflation expectations as they strive to anchor them at levels consistent with their inflation targets.

Strategies for Inflationary Environments: A Pragmatic Approach

Inflationary environments require individuals and businesses to adopt pragmatic strategies. These may include negotiating fixed-price